Willscot Holdings : Leader in modular and storage rentals in the US.

Willscot holdings is likely an unfamiliar name within your stock universe. They’re the market leader with approximately 50% of market share in modular units in the United States. This business boasts impressive 20% + operating margins, 40% + EBITDA margins, recurring revenues, high amounts of free cash flow and has excellent unit economics.

A) Business

Willscot Holdings is a leading rental business in the United States. They rent out modular units and storage container solutions to diverse end markets with over 85k customers primarily in construction, industrial, retail and wholesale, energy and natural resources, education, government and healthcare. As of their latest 10k Willscot has a total 156,000 modular units and 212,00 storage containers available for rent with an average utilisation rate between 60% - 70%.

If you follow my investments you will know I own Ashtead Group, another rental business. However, these businesses don’t cross paths as Ashtead primarily focuses on machinery, heating, cooling, scaffolding, traffic management and many other adjacent construction rental equipment whereas Willscot offers temporary “Ready to work” modular units and storage solutions.

The economics in this portion of the rental market are highly luxurious when we compare them with the two behemoths that are Ashtead and United rentals.

Firstly Willscots rental assets have a life span of 20 - 30 years with a residual value after their expected lives of over 50%.

Secondly, their CAPEX requirements are a lot less due to the simplicity and the longer replacement frequency of their assets. They are basically steel and aluminium boxes that’s modified to the specific needs of their customers.

(Image below demonstrates the excellent economics of their assets)

Third, due to the longer rental periods of modular and storage containers (3 years on average) takes away a huge chunk of logistics costs and also produces predictable recurring revenues.

These advantages result in higher margins, recurring revenues and high disposable cash flows to shareholders. Its fairly a simple business model and one I believe is being overlooked by the market, after all, it’s a pretty boring business.

In this article I will break down the business into 1) Products 2)Industry 3)Capital allocation 4)Management 5)Valuation.

B)Products

1B) Modular Units

We’ve all seen these “temporary” buildings whether it be on a building site, Educational facilities or hospitals. They are generally made from steel and aluminium frames and vary in size and can be as small as 24 square feet with other larger units available. These unis can be coupled together and stacked to the customers desired specifications up to a limit of 10,000 square feet.

Depending on the customers requests, these solutions can be fully equipped “Ready to work” and can be delivered with air conditioning and heating, electrical and Ethernet ports, plumbing and utility hook ups, as well as Willscots proprietary line of furnishings, appliances, restroom facilities and fitted with carpet or tile which they refer to collectively as Value-Added Products and Services (“VAPS”). These solutions often facilitate large projects and can be spec’d to the high standards as a normal building and are cost efficient for the customer. Below is a large project for the NFL Los Angeles Rams which consists of 88 modular units equipped with meeting rooms, a gym, hydrotherapy areas, locker rooms, a visitor entry pavilion, storage, dining, and a prep kitchen with cold storage for team convenience and efficiency. Take a look at the full project here.

There is simply no limit to what Willscot can achieve with these units. The huge advantage is the time taken to erect sites. A normal construction build of this size could take months and the capital outlay would be large for the customer. According to Willscots presentations, these units cost as little as 50 basis points of your regular project cost which can be a huge positive for future price increases.

These units have excellent economics. First, these units have a residual value of over 50% at the end of their useful lives. With a useful life of 20 years from date of acquiring or refurb, these units have minimal replacement costs with Willscot being able either sell old units which aids to the purchase of new ones or they have an option to refurbish older fleet.

2B) Storage Units

Willscots portable storage containers are made from weather‑resistant corrugated steel and are available in lengths ranging from 5 to 48 feet with widths of either 8 or 10 feet. These containers can also come with Value-Added Products and Services (“VAPS”) which include partitions, ramps, lighting, shelving, and other interior organizational solutions, including PRORACK, Willscots innovative complete system of sturdy readily movable surfaces. In this segment Willscot also offers standard storage and climate-controlled containers, walk-in freezers, refrigerated storage trailers.

These solutions are a cost effective and safe alternative to mass warehouse storage and job site security.

Again, like their Modular counterparts, these units have excellent economics with a useful life of 30 years and high residual costs at end of life. A properly maintained container is essentially in the same condition as when it was initially acquired or remanufactured. Below are the range of containers offered.

3B) Value added services

Here Willscot lease furniture, steps, ramps, basic appliances, internet connectivity devices, integral tool racking, heavy duty capacity shelving, workstations, electrical, solar panels and lighting products and other items for their customers for use in connection with their leased products.

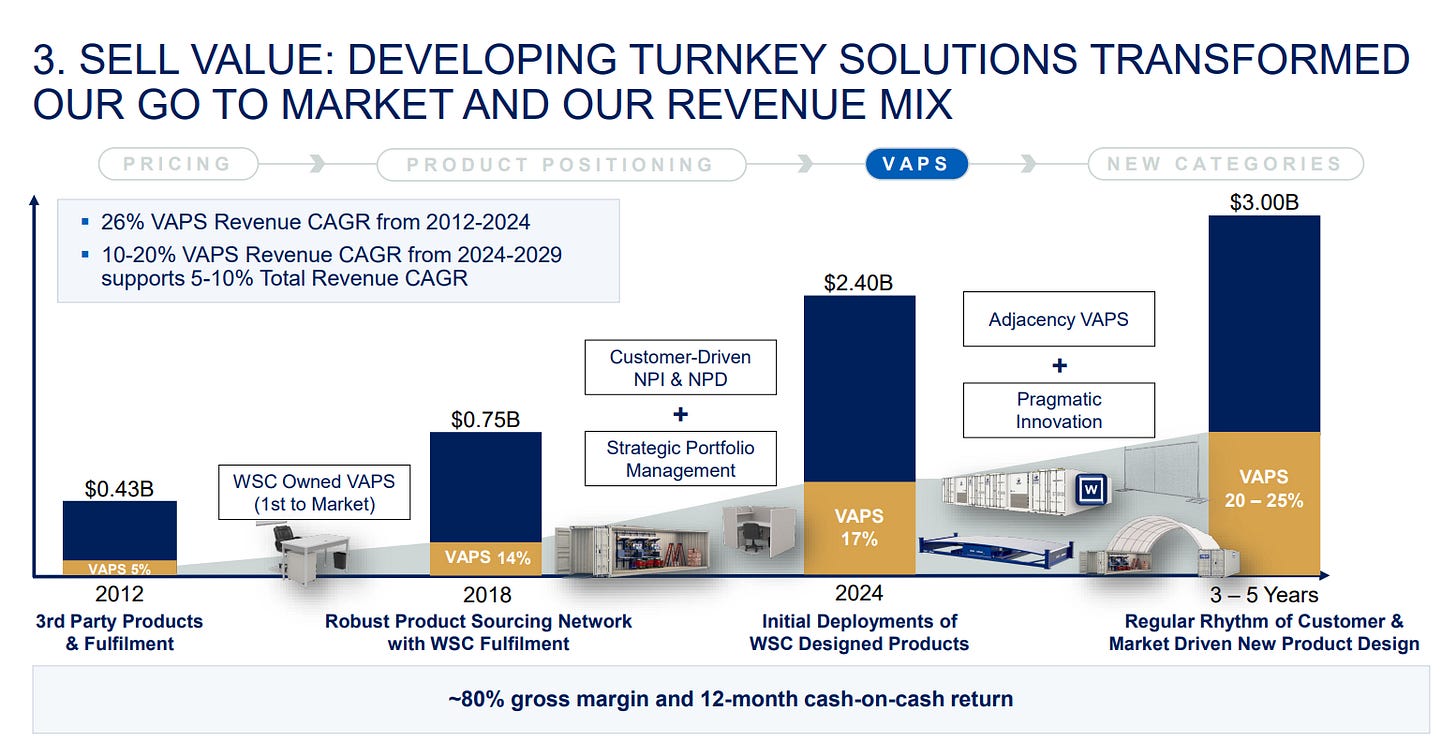

Although this segment is rather small, its their fastest growing category with a 26% revenue CAGR from 2021 - 2024 with a cash-on-cash return of 12 months with gross margins of 80%. Willscot anticipates VAPS will become a larger percentage of total revenues as time passes which should expand margins. With revenue contribution of 15% in 2024, Willscot believes they a can grow this segment to 20%-25% of $3 Billion of revenue by 2029.

C) Industry

The global rental industry is broad with many types of rental offerings such as residential, commercial, equipment and vehicles. The industries performance is generally tied to the health of the economy with growth in construction starts being a huge driver for rental demand in the commercial and equipment markets and higher disposable income a tailwind for vehicle rental and residential.

The different types of offerings within the rental industry have different dynamics and cannot be compared like for like. As an example, the assets rental companies own might have different requirements for maintenance, different customer frequency lease terms and shorter/longer lifespans. As we are focusing on Willscot in this article we will focus on their commercial / construction rental offerings of temporary space solutions and portable storage.

Personally, I believe Willscot has better economics than its construction equipment counter parts. This is mainly due to the lower reinvestment rates and in turn, are able to deploy higher amounts of cash flow to either grow the business or distribute it to shareholders.

30 Year lifespan on assets.

Low cost maintenance on assets.

Longer rental frequencies (3 year average terms resulting in Predictable recurring revenues)

Less sensitive to economic downturns.

Assets have a 50% residual value at end of life which contributes to fund new.

Willscots TAM is rumoured to be approximately $20 Billion Dollars and is a fraction of the $109 Billion Dollars overall construction rental market. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.43% during the forecast period from 2025 - 2034. This growth is backed by the structural shift of customers choosing to rent rather than own.

Inflation is another important factor to consider in the rental industry and is generally a good hedge against it. Rental companies can raise prices accordingly with a huge factor being that their services are a small portion of the customers total project cost,(Willscot estimates their solutions account for 0.5%) these price increases can offset declines in rental volumes during times of low utilisation which has been the case with Willscot during 2024. Also in some cases their assets value can increase in the second hand market resulting in higher cash obtained from the sales of older fleet.

Debt is no stranger in the rental industry. Many businesses choose to use the capital markets to fund their growth. I have to say, if debt is a key factor in choosing businesses to invest in then maybe the rental industry isn’t for you as most are highly levered. Willscot is no different. As of their latest report they currently have $3.5 Billion in long term debt with their nearest maturity of $527 million due in 2025. They have a target leverage range of 3x - 3.5x debt/Adj EBITDA and are currently within this range at 3.5x.

D) Capital allocation and growth

Willscots capital allocation framework are as follows,

Grow the business organically (Investing in new rental assets and in adjacent categories such as Value Added Products VAPS)

Maintaining leverage within their target range.

Opportunistically enter the M&A market ( The rental market is highly fragmented with low barriers to entry. Its not uncommon for large players acquiring bolt-ons to enter new markets and consolidate)

Share repurchases (Buybacks have been Willscots preferred method of distributing cash back to shareholders)

Dividends (A new dividend policy was recently agreed by the board with a quarterly dividend on 0.07c)

Maintenance capex is an important factor. Unless the company specifically points this number out, there is no other way other than try to guestimate it yourself. This figure can tell the investor the cash that’s needed to be put back into the business to keep its competitive positioning, with the rest being able to deploy wherever management believes will produce the best returns. During an earnings call in Q4 2023 management did have this to say,

“We invested $185 million of Net Capex in 2023, which approximates maintenance levels given our lower fleet utilization”

This works out as 25% of maintenance capex during the year and is relatively low when we compare other rental businesses. Willscots high cash generation of around 75% of OCF gives me confidence of many levers management will be able to pull in the near future.

One highlight I would like to point out is the significant buybacks during the past few years. We can see in the chart below shares rise in 2020. This was due to the acquisition of Mobile mini which was an all share purchase. Since the acquisition Willscot has reduced shares by 19.85% being their preferred method to return excess cash to shareholders.

Looking ahead into the business growth, Willscot believes VAPS will become a bigger portion of the business as they focus to penetrate these products into their existing rental fleet. During the next 3-5 years this category is projected to grow to 20-25% of sales of $3 Billion. Theoretically, this should be margin accretive to the business as VAPS produce 80% gross margins and have a 12 month cash on cash return. The majority of organic growth will be spent here IMO.

On the M&A front, Clearspan and cold storage are two categories Willscot have started to shift their focus into broadening their offerings to customers, especially retail. These Clearspan and cold storage solutions are perfect for large retail for temporary storage facilities.

E) Management

During deep dives its essential to look into the management team, after all, your essentially handing over your capital into the hand of these executives. Looking into their incentives and the CEOs skills at capital allocation can be good indicators to see if there aligned with shareholders. His/Her skills at capital allocation are hugely influential on stock returns.

The CEO and President of Willscot is Bradley Soultz who’s been in these roles since 2017. Under the stock ownership guidelines for executive officers, Willscot demands the CEO to hold at least 6x base salary in Mr Soultz case its $1.01m annually which results a minimum of $6m in company shares, he surpasses this amount with ease. Looking into the proxy it shows a significant portion of executives pay is incentive-based and therefore at risk. 88% for the CEO and 79% for other executives are performance based, which again puts their interests in line with shareholders. Performance based RSU will be measured by total shareholder return relative to constituent companies in the S&P MidCap 400 Index.

Looking into insider ownership, executive officers own a total of 3.3% of the business. Jeff Sagansky, Director (owns the largest amount with 2.5 million shares) followed by Erik Olsson, Chairman of the Board (1.3 million shares) then Bradley Soultz. CEO (1.2 million shares). There seems to be a fair amount of insider ownership here with values between $25 - $55 million dollars each.

Capital allocation is tough to analyse and only in hindsight can acquisitions and share buybacks be good indicators that capital was spent well. On this topic however, its easier to see if capital was spent unwisely, with high prices for acquisitions and consistent buybacks regardless of stock price. No red flags where present within my research. One huge win in my opinion was the acquisition and merger of Mobile Mini. After they merged, margins grew significantly. (Image below) showing the advantages of the scale synergies inherent within the rental industry.

F) Valuation

In valuing Willscot Holdings I’ve decided on an Exit multiple model. Here, I’ve projected revenue growth of 6% with Operating margin expansion in anticipation customers will increase their purchase of Willscots value added products. Like I mentioned (VAPS) have excellent economics and should be margin accretive as they become a bigger portion of revenues.

Capital structure is split 72/28. As the share price is depressed today, Willscots capital structure is disproportionate and uncommon. I’ve used the average capital structure since the merger of Mobile mini in 2020. For those wondering why I do this is to get a value of the equity in the later stages of the model.

Share count has been decreasing 6.5% annually since the merger. As this is considered high I’ve lowered my target to 3% reduction annually. This is due to the uncertainty of knowing managements priorities with Willscots disposable cash as there are many avenues they can walk down, paying down debt or acquisitions are options here.

Here, I have a target price for Willscot of $60 in year 5. This is concluded from EBITDA of $1.29Bn with an exit multiple of 10.5x. Currently the stock is below the buy prices of both the 10% and 15% IRR which suggests undervaluation from my assumptions. However, these might not materialise.

Disc. Willscot Holdings is a new position in the DInvests portfolio as of April 2025 totalling 3.7%.

Conclusion

I believe Willscot Holdings to be an excellent business. As I highlighted in the opening statement they have impressive margins, recurring revenue streams, high cash flows and excellent unit economics.

With rate increases and increased utilisation, not only from Willscot but from their peers should change the market sentiment around the rental industry along with lower interest rates boosting construction starts. Although, I don’t believe Willscot is cyclical, far from it. Their recurring revenues keep revenues fairly predictable but as a rental company they still get treated as such around the cyclicality of the industry. Have we reached the trough? Who knows. But I suppose its better then buying at a cyclical peak.

The advantages Willscots solutions offer their customers from,

“Ready to work”

Construction time advantage.

Scalable to 10,000 square feet.

Cost.

Structural changes from own to rent.

Customisable to suit customer needs.

Will drive continued demand far out into the future.

Thank you for reading

DInvests

DRGInvests on X

If you’ve enjoyed this article be sure to read my previous articles which you can access here

Disclaimer: I have a long position in Willscot Holdings. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.