Eurofins Scientific : Industry leader with a widening moat.

Founder led with skin in the game.

Are you looking for a high quality business that’s founder led with excellent capital allocation skills? Operates in a resilient, non-cyclical industry? An industry leader with attractive long-term growth prospects?

Eurofins Scientific $ERF.PA ticks all these boxes.

Initially put on my radar after reading Francois Rochon fund letters after he quoted this,

“We think Eurofins, led by founder-CEO Dr. Gilles Martin, remains one of the highest quality businesses we own.”

I’ve come to the same conclusion.

A) Business Overview

Eurofins scientific, headquartered in Luxembourg, is a global leader in testing and certification services. It was founded in 1987 by its current CEO Giles Martin who’s family still own 32% of the outstanding shares.

Since its IPO on the Euronext Paris Stock Exchange in October 1987, Dr Martin has compounded Eurofins stock over 20% annually. Put another way, in October 2022 Eurofins stock price had risen 36,000% or 27% CAGR, the only other stocks to achieve these figures within the same 25 year time frame are Monster Beverage, Amazon and Apple.

When the business was founded in 1987 Eurofins had 4 employees with 1 laboratory, built on a patented niche analytical testing method used to verify the origin and purity of several types of food and beverages.

Today, after shrewd capital allocation through M&A, Eurofins is a leading provider of analytical and certification services with a network of more than 900 laboratories, 62,000 employees in 62 countries. They’ve broadened their service offerings which now consist of testing of food, beverages, pharmaceutical, environment, forensics and materials, whilst also offering services to the biotech industry through contract manufacturing and clinical solutions.

Eurofins currently offers over 200,000 analytical methods and performs 450 million tests annually. These tests evaluate the safety, identity, composition, authenticity, origin, traceability, and purity of biological substances and products. The rise in the awareness of health, the increased average age expectancy and the increased regulatory landscape are huge growth drivers for Eurofins. These costs businesses incur are non-discretionary and are resilient through all market cycles making their testing revenues fairly predictable. Businesses, that have historically done their own testing in-house are outsourcing testing to reduce costs.

B) Business model

Due to the large amount of companies under the Eurofins umbrella and various regulations across different regions, Eurofins have implemented a decentralised business structure. They believe this entrepreneur-led structure promotes closer relationships with, and more individualised services for clients while encouraging scientific innovation. Each business is essentially left alone with full autonomy with Eurofins at hand with investment if needed.

Each region has its own “HUB AND SPOKE” model. This laboratory network that Eurofins have strategically built, is comprised of many local laboratories (SPOKES) which cater local customers with immediate standardised testing services and larger more specialised testing centres (HUBS) which constantly work together to share significant synergies among each other. Where new tests are developed, Eurofins companies can quickly roll out these tests through their network. This results in quicker time to market, better efficiency and world class customer service.

Eurofins has also invested heavily in their “World class” propriety IT solutions. This IT infrastructure is a critical chess piece to the efficiency and accuracy of Eurofins testing solutions and the value provided to their customers. All the data and test results can be shared in real time to other laboratories and their customers in-house systems. This creates fast turn-around times, unmatched within the industry creating high retention rates among customers.

The investments made thus far have been exceptional. Eurofins continues to invest in a network of state-of-the-art laboratories and equipment to remain at the front of scientific innovation and ahead of competition. Leveraging their network, they provide their clients with the highest quality of service and the best possible turnaround times, both key elements for customers.

C) Capital Allocation

One of the most important qualities in a CEO is to deploy capital at high rates of return. I can’t remember seeing a superior CEO at deploying capital as consistently as Dr Martin. I explain the reasoning around M&A and start-ups, with why they pursue one over the other based on hurdle rates below in the (Growth section). The other deployment of capital is share buybacks and investments in owned sites, ill cover both here. Again, there’s a clear trend of purchasing more when the shares are low and purchasing less when shares are high. As you can see in the image below, Eurofins seem to be buying much larger tranches in the mid 40 Euro region and are currently buying back shares aggressively. Link attached here, you can see all tranches back to mid 2022. If I’ve counted correctly they’ve repurchased over 5 million shares in 2024.

Another lever is the purchase of owned sites, this strategy is purely to lease less to increase profitability in the long term. Since 2018, the net floor area of buildings owned by Eurofins has more than doubled from 240,000 m² to 550,000 m². Going forward they plan to spend 200 million Euros annually to increase the portion of owned sites.

D) Growth

Eurofins growth comes from the following. Organic industry growth, M&A and start-ups.

Organic growth needs no explanation but the other two I’ll cover. Eurofins’ markets are highly fragmented with many smaller and medium-sized laboratories offering a limited portfolio of tests. Eurofins playbook is to consolidate its industry through small bolt-on acquisitions. For context, after looking through 10 years of annual reports I counted a total of 364 completed take overs. These acquisitions creates scale economies, broadens their portfolio offerings and onboards leading talent which in turn, increase their hub and spoke network and their competitive advantage. These purchases are carefully selected and are only pursued when they cross Eurofins hurdle rate. This disciplined capital allocation approach has proven highly successful and I don’t see them slowing down anytime soon.

This brings me to start-ups. Whenever acquisition targets become too expensive and don’t cross their desired hurdle rate, Eurofins generally builds out new labs in high growth/ high return areas and new markets. Since 2000 they have opened 301 new start-ups which now contributes to 629 million Euros in the latest financial year. One positive of start-ups is there’s no goodwill involved which eliminates any future impairment risk, the downside however is the timescale these new labs require to reach the profitability of the more mature labs. Management have stated start ups generally take 5 years to reach the companies EBITDA levels. The rise in start-ups over recent years will provide operating leverage in years to come as they mature. This capital deployment optionality gives Eurofins the freedom to pursue whichever avenue they believe is most beneficial for the company and shareholders. Although start-ups decrease short term profitability, over the long term they’ve proven to be highly beneficial.

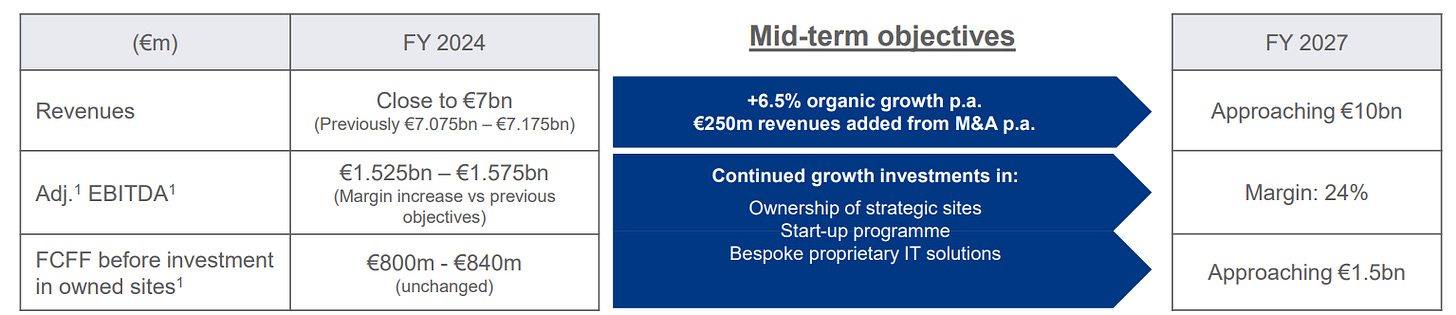

In the latest presentation, Eurofins have set a target of 10 Billion Euros in annual revenue by 2027, this growth will be contributed from 6.5% organic growth annually with 250 million Euros from M&A.

I will use these assumptions within my valuation model later on in this article.

E) Valuation

Eurofins shares are currently trading around their lowest multiples in a decade. This is due to the loss of covid revenues from their 2021 peak and also profitability pressure from inflation.

If we use managements guidance of 10Bn in revenues with 24% Adj EBITDA margins (to get in the ballpark of actual EBITDA margins I’ve taken -150bps resulting in a 22.5% EBITDA margin) and putting their median multiple of 13x we get an EV of €29.25Bn.

If we then use their current capital structure of 30% debt and 70% equity we get a market cap of €20.4Bn.

This would result in a share price of around €108 give or take over three years to FY 2027, this would result in an annualised return of just over 30%.

These assumptions might be too optimistic so if I drag out these over 4 years the ARR will reduce to 21%

Both scenarios offer good returns from todays price of €49 and change.

This valuation model is highly sensitive to the exit multiple so I’ve created a sensitivity analysis. In the example that follows keep in mind that all outcomes have one commonality and that is a 22.5% EBITDA margin, the rest varies as the tables show. We have 11,12,13x Exit multiples with Revenues of €8,€9,€10Bn.

As you can see, we have a price range between €73 to €108 in my model for FY 2027. Both ends offering good returns IMO.

F) Conclusion

In my personal opinion, I believe Eurofins shares are trading at an attractive price for the long-term shareholder. If you follow my content, you will know I own Eurofins and it currently accounts for 6.7% of my portfolio.

Eurofins CEO is one of the best I’ve come across in terms of capital allocation. His consistency and discipline sacrifices short term profits for long term gains, actions we don’t usually see on Wall Street. Dr Martin as CEO, is a large portion of my thesis and with a 32% family stake in the company I can’t see him leaving anytime in the near future. Looking into the future I see further consolidation, more start ups in fast growing markets and more investments in owned sites (resulting in operating leverage long term).

I believe Eurofins is a world class company and the market will award the business and shareholders with the appropriate multiples in the future. In the meantime I’m more than happy for the company to repurchase large tranches at these low multiples.

I hope this article attracts your interest for further research into this business.

Thank you for reading

DInvests

DRGInvests (On X)

Disclaimer: I have a beneficial long position in the shares of Eurofins Scientific. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

What are your thoughts on MW? Seems detailed but the detail is above my paygrade

I think this is a very compelling business to cover, great choice! (Disc: I own the stock).

What I'm still trying to figure out is if there's a high-ROIIC runway outside the "Testing" market, namely in the "Diagnostics" market where the company may deploy the majority of its future reinvesting capital. An InPracise interview has a quote (not behind a paywall) that says developing new diagnostics costs capex, but these new diagnostics become commoditized over time. This ROIIC will determine the stock's compounding potential.

p.s. There was some controversy around this stock last year (short report). I just mention this for completeness, not to open a discussion, and apologies if you've already mentioned it elsewhere.