I usually write about companies I own. This time, I’m writing about a company I wish I owned. Otis Worldwide has been on my watchlist for a long time, however, the stock seems to be stuck on the top floor with no signs of returning down to my entry level.

I first came across the business when I was away travelling and as I stepped into the hotel elevator I seen the “OTIS” logo. With my investing head on, I took a mental note to look up this company in my free time. I do this quite regularly and I’m sure you do to.

So, what did I learn?

Otis is the world’s leading company for elevator and escalator manufacturing, installation and service offerings.

They have 2.4 million installed units which move 2.4 billion people daily.

Otis pioneered passenger elevators.

Otis services 2.4 million units ( A growing category )

Otis was spun-off from United Technologies in 2020 along with Carrier.

Majority of their revenues are recurring. (primarily through service and maintenance contracts for elevators and escalators)

Operate a razor blade business model.

Before we get into the business, lets start from the very beginning.

A) Founding roots

Otis was founded by Elisha Otis who invented the safety elevator in 1853. Prior to his invention, elevators had been around for centuries mainly to carry goods but they where not yet considered safe for passengers. A cut rope on a top floor building would surely result in instant death. Elisha Otis devised a safety stop that would catch a falling elevator. The safety elevator was born.

In 1854 people where still hesitant to climb aboard. That was when Elisha Otis decided to use an exhibition in New York as a marketing platform and set up a full-scale model to demonstrate his invention. As the elevator reached the top, Otis ordered the rope to be cut and the safety mechanism came into use. Otis repeated this exercise every hour to gain as many eye witnesses possible.

The safety design was fairly simple. Powered by a steamed engine located in the basement (2), Otis used toothed guard rails (6) that when the tension was released the hoist (4) would drop and throw the spring mechanism (5) outward into the notches, preventing the cabin from falling.

After his successful demonstration, confidence in the safety elevator took off with orders pouring in. This transition from goods to people changed the way the public viewed tall buildings. Lower floors where considered more desirable as they didn’t require climbing up many stairs, the higher the floor the lower the rent.

The first passenger elevator was installed in 1857 at 488 Broadway, the great Haughwout Building, New York. After a few decades, cities in America grew taller with the invention of the safety elevator making tall buildings practical. Otis founded this industry and is still the largest among its competitors today.

As you can imagine, the elevator industry has evolved over time but the same safety principle still exists. Starting off with a steam engine, hydraulic and then the electric motor, speed, efficiency and autonomous elevators are now standard in society.

On September 20, 2023, marked 170 years of business for Otis Elevator Company.

Otis vision “We give people freedom to connect and thrive in a taller, faster, smarter world.”

B) Otis Worldwide

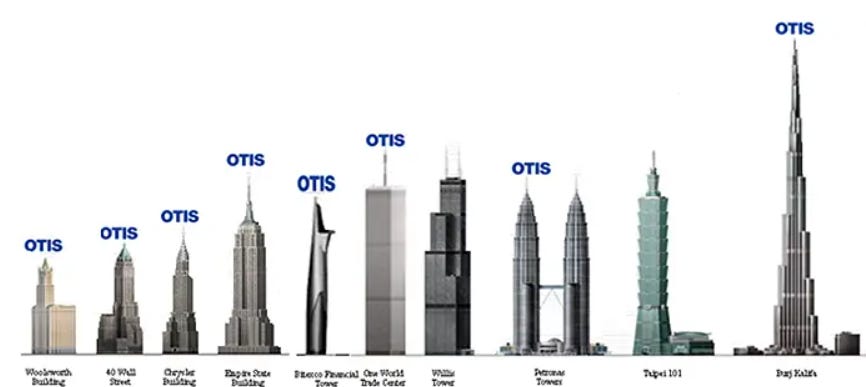

Today, Otis has evolved into a powerhouse with revenues above $14 Billion and operations worldwide. Their elevators and escalators can be found in the most iconic buildings around the world including The Eiffel Tower, Empire State Building, Burj Khalifa and Petronas Twin Towers to name a few.

Expectations for convenience, safety, efficiency and reliability, along with effortless travel is mandatory in society keeping demand high in this resilient industry. Growing cities and urbanisation can be considered factual in the coming decades. Afterall, humans are hard wired to keep progressing, cities will become larger and buildings will become taller. This gives me confidence in the future demand for Otis offerings and the industry as a whole. 100 years from now, unless someone invents a teleportation device then elevators are here to stay.

B1) Products

Escalators and moving walkways

Otis started off as an elevator company but as society and technology has evolved, the way buildings are designed and the appeal of a seamless effortless journey, escalators and moving walks have also become standard in high traffic public spaces. Think airports, railway stations and shopping centres. Otis offers link escalators and moving walks to customers with bespoke designs that complement the architecture of their buildings. Safety, efficiency and sustainability are top priorities for Otis and its customers.

Here Otis offers these products with the following selling points.

Energy efficient products with 60% reduction in energy usage that use the Otis Re-Gen drives.

“SAHS: Self-Adjusting Handrail System” This safety mechanism adjusts handrail tension to an appropriate level at all times, this eliminates any potential issues. If the handrail is too loose or too tight, the tension level is adjusted dynamically and automatically through a control signal that is sent to the SAHS motor.

Link escalators are built using 90% of recycled materials.

Elevators

Otis elevators consist of many models that are suitable for all types of buildings, whether it be a low-rise, mid-rise or a sky rise buildings. One thing they all have in common is the Otis standard of innovative elevator technology, comfort, reliability, and performance for all price points. Otis guarantees customers 20 years of efficient, safe service without downtime (This is assuming regular service and standard maintenance). You guessed it. Again, these products are tailor made for the customer with designs that’s suited to the specific buildings architecture.

Models include

Gen 2

( Known for its proven design and efficiency, the Gen2 series includes models like Gen2 Life (machine room-less for residential buildings), Gen2 Stream, Gen2 Flex, and Gen2 Prime (budget-friendly for residential buildings).

Gen 3

(Latest models : This series brings connectivity to the platform, with models like Gen3 Edge and Gen3 Core, designed for low to mid-rise residential and commercial buildings.)

Hydro Fit

(A machine room-less design that’s well-suited for smaller building projects where space is a premium.)

Skyrise

(Designed for high-rise applications, the Skyrise series offers high-speed, gearless lifts.)

Sky build

(Built and used during construction, once complete it goes straight into service as a Skyrise elevator)

Otis newest models are connected through Otis ONE, a cloud based service solution that has many benefits for the customer and service teams. These new elevators and escalators connected to Otis ONE (Currently 900,000 units connected and growing) can see real time performance, monitoring and troubleshooting where service engineers can see before hand any issues that may cause breakdowns, resulting in equipment downtime. These solutions improve customer experiences and increase service performance. The newest models are the Gen3 Core and the Gen360.

Elevators can also be fitted with the latest elevator management systems such as the Compass 360 which offers shorter wait times and faster, more efficient journeys (Its basically a digital concierge) and the Panorama 2.0 EMS system which gives building staff real time monitoring and performance metrics with other data driven insights. I believe Panorama 2.0 is an essential tool for sky rise buildings.

Choosing Otis, their portfolio of offerings gives customers all their building transportation needs whilst also partnering with the industry leader. The reputation for safety, reliability, comfort and speed gives the confidence they’ve chosen the best possible option for their passengers.

B2) Service segment

Otis is the largest service provider in the industry. Through their Service segment, Otis performs maintenance and repair services, as well as modernization services to upgrade elevators and escalators. There are currently 2.4 million units within the service portfolio consisting of units manufactured and installed by Otis and units from other manufacturers.

This segment is the most beneficial to the business. As of 2024 service revenues comprised approximately 60% of Otis net sales and approximately 85% of their adjusted operating profit (24.5% adj operating profit margin). So we can confidently say this segment is the money making machine. As you can guess, this is where the razor blade terminology comes into play. New unit sales are essentially sold near cost with the high profits being obtained from after-sales of their maintenance and service contracts.

Modernisation of existing units is also included here. According to the latest letter to shareholders there are approximately 7 million units installed globally that are over 20 years of age (Past their life expectancy). Modernisation offerings can range from relatively simple upgrades of interior finishes and aesthetics to complex upgrades of larger components and sub-systems. Launched in 2023 in the Americas, the GEN3 MOD Plus modernisation offering for residential, commercial, hospitality, medical or industrial buildings includes built-in connectivity to Otis ONE IoT digital platform. There’s huge untapped opportunity here as Otis can onboard customers that used a different manufacturer for their initial install. (Image below shows the new eView IoT monitor inside Gen 3 elevator cabs) This in-car display streams live, customizable infotainment to passengers and can connect them to OTISLINE, Otis' 24- hour service call centre, during an emergency.

C) Industry

Operating in an attractive, reliable industry doesn’t come without its downfalls. Competition. As you all know, attractive returns attracts new entrants into the market in a hope to take market share, after all its not exactly fair for Otis to have all the pie. Over the years many entrants have entered this market but its fairly concentrated with three major players.

Otis Worldwide (15% market share)

Schindler Elevator (13.6% market share)

Kone ( 12.7% market share)

(Market share calculated by annual revenue/ global revenue)

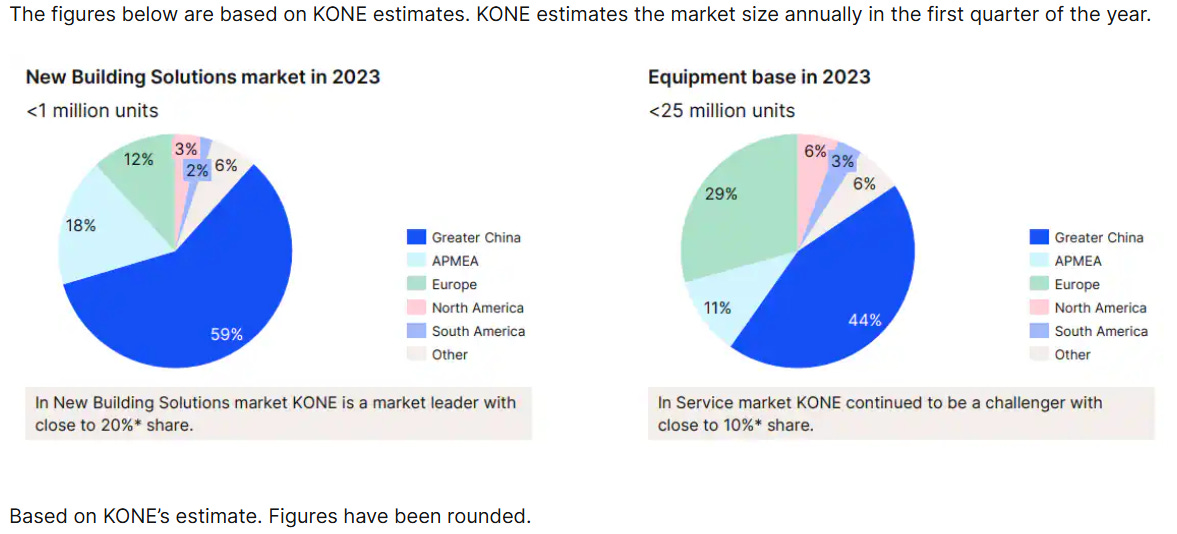

The global elevator and escalator market was valued at $94 Billion in 2024. (If we use Otis revenue of 14.2 Billion, they currently hold a 15% market share.) The market is projected to grow from $100.23 billion in 2025 to $167.62 billion by 2032, resulting in a CAGR of 7.6% during the forecasted period. This growth is driven by increased construction of high-rise buildings and skyscrapers, increasing aging populations, rising urbanization, favourable government initiatives and a current installed base that’s past its expected life that requires replacement or modernisation upgrades. The Asia Pacific is dominating this growth as published by Kone (Image below)

As you can see, China in particular dominated new installs during 2023 with 59% and they command 44% of the total installed base globally. Looking out into the future, strong growth is anticipated for both China and North America.

The industry is also highly regulated. Passenger safety is paramount and building owners are required by law to have their escalators and elevators inspected legally every 6 months, however, different time scales are recommended depending on the type of equipment and level of use. Otis recommends inspections once a month. These service inspections generate high recurring revenues and as the installed base grows, creates a flywheel as generally customers sign service contracts that usually last 60 months at a time. Depending on level of service throughout this contract (Otis boasts excellent 24/7 customer service) I’m also expecting customers to continue its services for the duration of the elevators life. As mentioned earlier in the article, service revenues are a key ingredient to Otis profitability and I’m expecting continued excellence in their service offerings.

D) Growth

Otis growth comes from new units installed, modernisations of aging units, maintenance & repair and bolt on acquisitions.

New unit growth has slowed in recent years with organic growth in the low-single digits and more of the same is expected in the near future. Afterall, a huge capital outlay is required here and with interest rates at the high end when comparing to the previous decade its understandable growth in this area has slowed. During 2024, Otis obtained a 20% market share of new units installed.

The real value and appeal with Otis is the massive opportunity to grow its services revenues. Service revenues as mentioned above, comprise of modernisation revenues and maintenance and repair revenues.

According to Otis most recent annual report, there are currently 21.5 million units installed globally with anticipated annual growth to be in the mid-single digits. Of these units, Otis currently services 2.4 million units (Latest report) . There is a huge untapped opportunity here. Also, of these 21.5 million units, 7 million are over 20 years old. Aging elevators across the globe require technology and other upgrades with Otis at the forefront to capture this growth opportunity. During Q4 2024 modernization orders increasing by 17% which shows the continued momentum. (Image below shows % of revenue increases y/y within service segment)

Of these service revenues there is a huge distortion of service sales and connected units in China when compared to the total global units in operation, this is due to the average life of elevators in China being 15-20 years old. Looking at the numbers, China currently has a 44% market share of the 21.5 million units globally. When looking at Otis report you can see the low % of service sales and connected units. Otis is well aware of this and believes they can grow their China service portfolio low-teens and modernisation over 20% annually.

E) Intrinsic Value

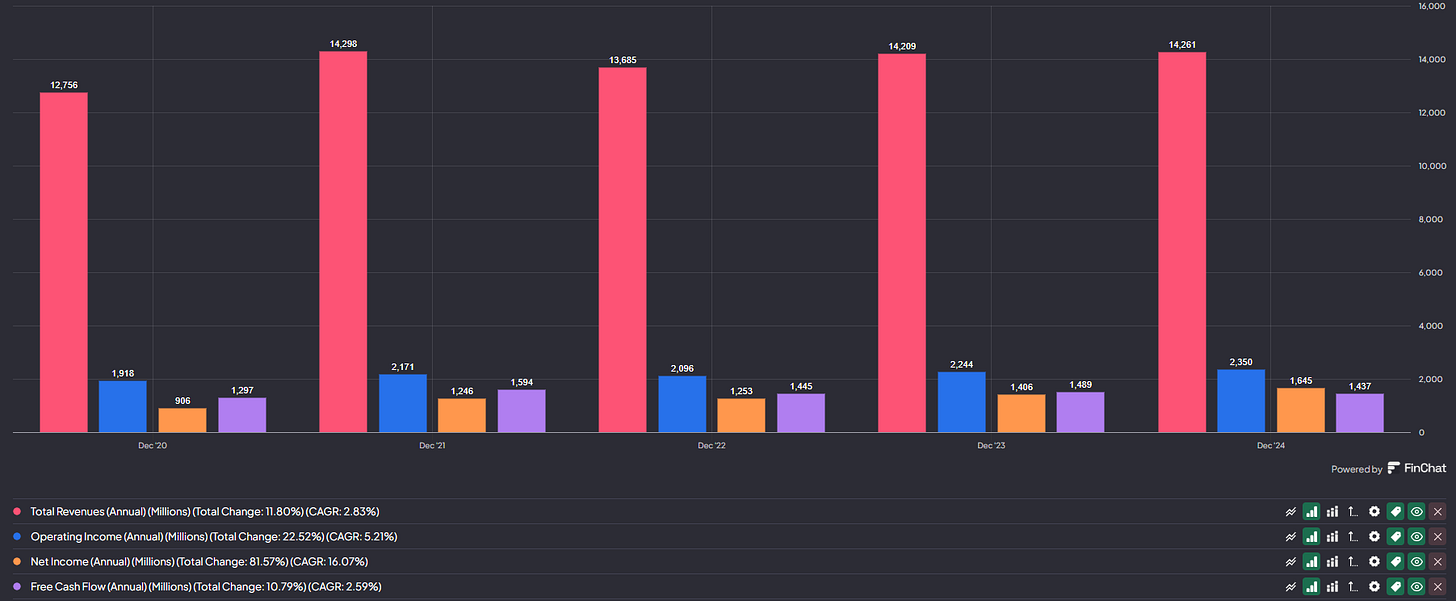

Before I get into valuing Otis, I want to show previous financials. Revenues, Operating Profit, Net Income and Cash flows are all important figures. Margin expansion / contraction are also highly relevant inputs into valuation modelling.

As you can see, revenue growth is low single digits. This can be misleading as in the most recent year, Otis sales in China declined 20% and the same trend was similar with their competitors. Profitability has been increasing higher than revenues due to the mix of sales. As you might have guessed, service revenues are continuing to become a larger percentage of sales and have far superior margins.

Here, operating margin has grown 150 basis points over four years. I will use the same expansion in my modelling as I fully expect service revenues to continue outpacing new equipment sales. (Valuation model below)

You can see my assumptions in the example above. Obviously, changes to any of these inputs can change the valuation dramatically. All my assumptions are not out of the ordinary for Otis and are very achievable in my personal opinion.

Based on this model the intrinsic value for Otis with a 10% discount rate is $93.50.

A 15% discount rate decreases its intrinsic value to $74.93.

A cause for caution here is the exit multiple. I’ve chosen a 27.25x (Considered high by market standards), this is Otis median multiple and its not uncommon for a high quality business such as Otis to trade at these levels. The risk here is any downgrades by the market. In other words Otis has no room for error, they must remain highly rated by the market.

F) Conclusion

What’s the investment case here?

Otis seems to be slightly overvalued based on the discount rates chosen at todays price of $100. Investment returns at todays price will probably be in line with EPS growth + dividends. For the investor that’s willing to accept lower returns for a predictable business with high recurring revenues then Otis could be a safe bet. Personally for me, I demand a higher margin of safety.

The industry Otis operates in is forecasted to grow 7.6% annually to a TAM of $167 billion by 2032. This growth is driven by larger cities, taller buildings and urbanisation. Customers are also required by law to have their units inspected and maintained regularly which contributes to predictable recurring revenues that are usually locked into contracts for 60 months at a time, sometimes longer.

A large factor is Otis ability to execute on their growth in China as the service market looks highly underpenetrated. One to look out for.

Overall, I believe Otis to be a high quality business and one I will be watching closely to see if any price weakness occurs in the near future. It will be in the DInvests portfolio one day but for now I’m happy to invest in what I believe to be higher returning investments.

Thankyou for taking the time to read this article

If you enjoyed please subscribe.

DInvests

DRGInvests on X

If you’ve enjoyed this article be sure to read my previous articles which you can access here

Disclaimer: I have neither a long or short position in Otis Worldwide. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.