Hello everyone and welcome to this months portfolio update.

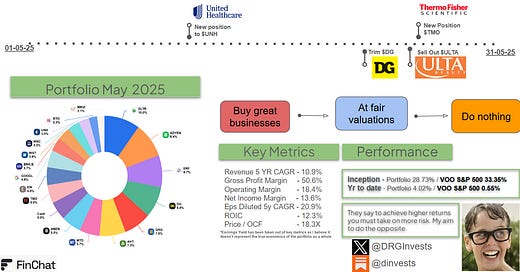

May was quiet on the activity front with two new positions added, one trimmed position and one sell. Again, similar to last month, I believe the DInvests portfolio ended the month stronger than it started. Lets dive in.

Positions sold

Ulta Beauty - Sold Ulta Beauty after their recent earnings report for a nice gain. I must admit, this position was rather frustrating. After entering into this position in the low $400 it was a drag on the portfolio over the last 12 months, sticking with my conviction and averaging down during the stock lows eventually paid off. One mistake during my initial research of ULTA 0.00%↑ was the misjudgement of their potential growth resulting in a higher rating and valuation on my part. After adjusting these growth forecasts (low to mid singles) Ulta Beauty looks fair value currently with forward returns that will probably mirror EPS growth in the mid-high singles when we consider share-buybacks.

Positions Adjusted

Dollar General - A common strategy I use when I know a stock I believe is severely undervalued is extend my ideal weighting. This was the case with Dollar General sub $80. The sale was purely to take profit off the table and decrease my exposure to a more ideal weighting. As you can see in this months image above I’m still heavily exposed in this industry with Dollar Tree and Dollar General and if the prices continue to increase I will continue to adjust my positions until both equal between 5-7.5% each.

New Positions

United Health - I added United Healthcare sub $300 which I believe on a risk/reward basis is favourable. All the market noise (Currently is all speculation) UNH is the largest health insurer in the US by far with half of their revenues from non insurance operations through Optum. At a 12x purchase price, I believe it’s a steal looking at the earning power of the company. Sure, if these allegations materialise and become tangible then the story changes and I’ll assess the company and its future prospects possibly resulting in a sale. I cant see much downside left with a huge amount of decline already baked into the share price. (Heads I win, Tails I don’t lose much)

Thermo Fisher - I added Thermo Fisher during the past week. After a 35% decline in share price due to the extended pullback in overall global biopharmaceutical spending, lowered 2025 earnings guidance of 5% due to the near term impact of tariffs and also a reduction in academic and government funding by the trump administration. For those who are unfamiliar with TMO, they have industry leading positions in Lifescience solutions, Diagnostics, Lab products and Pharma services including CDMO and CRO. Companies such as TMO, Sartorius and Danaher should all benefit from industry tailwinds such as an aging population and the high complexity of large molecule therapies who’s pipeline keeps increasing. Currently a 5% position, I’m thinking increasing the position during June.

Performance

May, the DInvests portfolio increased 7.48% compared to the index 5.59% ✅

YTD the portfolio is up 4.05% compared to the index 0.55% ✅

Since inception, I’m still lagging the index with total returns of 28.73% with the index returning 33.35% ❌

Substack Activity

During the month I published a deep dive on my newest position Mettler-Toledo and also an article on Greggs most recent trading update. Also, last months portfolio update is there for easy access.

Mettler-Toledo - Honest Weight

Greggs Trading Update (17th May 2025)

If you’ve enjoyed this update don’t forget to subscribe.

Thank you

DInvests

DRGInvests on X

Disclaimer: I have a beneficial long position in the shares mentioned in this article. My buys and sells aren’t recommendations. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

Ever looked into 3i given your exposure to the discount retailer segment? Steve and I think it's a very good outfit.

Why did you pick TMO over Sartorius and Danaher? Purely valuation? I like their portfolio the least of those three.