The newest addition to the DInvests portfolio for April 2025 was Mettler-Toledo MTD 0.00%↑ .

As my subscribers know, I look to add businesses that possess the following qualities.

Has excellent economics.

Has Pricing Power.

Is resilient to some extent during economic downturns.

Minimal risk to being obsolete.

Good growth prospects.

I believe Mettler-Toledo is an excellent candidate and correlates to the majority of these qualities.

As with most of my write ups, I write about businesses I own. This way, it keeps me accountable to do the hard work and truly dive deep into companies I’m considering to buy or have bought. I consider my Substack as a personal investing journal that I share with my Subscribers.

I hope you enjoy this deep dive on Mettler-Toledo.

1) History to Present

A brief summary into the history of both Toledo and Mettler.

1a) Toledo

Going back to 1890-1900 an inventor named Allen DeVilbiss, designed an automatic computing pendulum scale. After showing his invention to retailers and realising that customers appreciated the automatic computation which eliminated the risk of overcharging (A common practice in those days) it gained popularity. However, despite the potential evident in his invention, Allen DeVilbiss didn’t wish to make Toledo into a realisable business.

In 1901, a business man named Henry Theobald along with other investors grasped at the opportunity to acquire the business from DeVilbiss. “Toledo Computing Scale and Cash Register Company” was incorporated. By 1902, over 100 cash registerers with scales where being sold every month.

Theobalds previous employers National Cash Registerer Company threatened to sue the business for patent infringements. A deal was made where NCR would acquire all cash register patents and property with Theobald also agreeing not to participate in the cash registerer business in the future.

“Toledo Computing Scale Company” was born with a new slogan “No Springs, Honest Weight”.

This slogan caught wind. As mentioned above, a common practice among merchants and customers was dishonest weighting, resulting in customers overpaying. These where common on normal spring scales which where sold by Dayton Scale Company, Toledo’s Competitor. To strengthen Toledo’s products, Theobald campaigned for more regulation of weights and measures to eliminate dishonest weighing systems. Massachusetts adopted the first weights and measures laws in 1907.

Through strong corporate culture and business strategy Toledo Scale Company grew to become the largest producer of industrial and food retailing scale systems in the United States.

In 1957 Reliance Electric purchased Toledo Scale Company for $70 in an all stock purchase.

1b ) Mettler

In 1945 a Swiss engineer named Dr Erhard Mettler invented a single pan balance which gradually replaced the less accurate conventional two-pan balances using the “substitution principle”. The principle works by placing the unknown sample on the balance and then gradually adding known weights “calibration weights” until the balance is in equilibrium. Large production of the single pan balance began in 1946 with further improvements being introduced in 1952 with their “Microscale” balances. These balances where capable of measurements to 0.000001 grams. Scales evolved during the 1970’s with the introduction of electronic scales with Mettler introducing their newest model PT1200, a device capacity from 0g to 1200g to the nearest 0.01g. Further success and technological advancements enabled Mettler to then roll out their “DeltaRange” balances in 1979, which was awarded the IR100 Award and voted one of the most significant technical achievements for the year.

International expansion followed with subsidiaries located in the United States and throughout Europe. These strategic moves enabled Mettler to operate closer to its client base with local sales staff, a strategy that’s still centred around Mettler Toledo today.

Over time, Mettler diversified its product line by introducing thermal analysers and automatic titration systems. For those unsure what a titration system is, it’s a technique where a solution of known concentration is used to determine the concentration of an unknown solution. I’m sure we all have memories using this technique back in science class. A simple diagram below shows how its performed.

In 1980 Mettler was purchased by Ciba-Geigy and was added to their industrial segment. During the time Mettler was under the Ciba-Geigy umbrella, they diversified into different markets including industrial and food retail. Mettler also diversified further within their laboratory market with their first automated lab reactor, the Mettler RCI.

Over the next few years Mettler continued its acquisition spree further adding products in new markets. However one would change its name.

1c) Mettler-Toledo

In 1989 Mettler acquired Toledo Scale Corporation from reliance electric which was then the largest producer of industrial and food retailing scale systems in the United States. Following the acquisition Mettler restructured and renamed the business Mettler-Toledo AG.

More acquisitions followed, Ohaus Corporation being one to broaden its product portfolio and further advancements in new balances such as the TA8000 and AT 10005.

In 1997 on November 13th Mettler-Toledo was listed on the NYSE by selling 6.67 million shares at $14 per share. The capital raised would fund further acquisitions to broaden and consolidate its markets. Major acquisitions include.

Safeline (Metal detectors for packaged products)

Bohdan Automation (Laboratory automation and automated synthesis equipment)

Applied Systems (Reaction analysis instrumentation)

Myriad Synthesizer Technology (Instruments that facilitate and automate the synthesis of large numbers of chemical compounds in parallel)

Testut-Lustrana (Manufacturer of industrial and retail scales)

Henry Troemner ( Supplier of lab equipment, weights and weight calibration)

Rainin (Supplier of liquid handling solutions, which are widely used in life science and biotechnology laboratories)

PendoTECH (Leader in single-use sensors, monitors and control systems for data acquisition and process control)

Today after strategic acquisitions and innovations through an extensive R&D budget, Mettler-Toledo is the number one leader in the majority of markets it operates in with their solutions being critical in key research and development, quality control, and manufacturing processes for their customers in a wide range of industries, including life sciences, food, and chemicals.

One huge advantage is their increasing installed base of products which drives replacement demand, “MTs products are rather inexpensive with an average price of 5k per unit which enables customers being able to easily replace older units as it accounts for a small percentage of their total R&D budget” gather critical data and is integrated seamlessly for their customers through Mettler-Toledo’s software solutions LabX. This flywheel locks in customers as switching providers of balances and lab equipment could be too costly as data, re-training and the risk of switching to less quality products could harm customers workflow and reputation.

Mettler-Toledo business is also geographically diversified, with net sales in 2024 derived of 42% from North and South America, 28% from Europe, and 30% from Asia. Their customer base is also diversified with no one customer accounting for more than 1% of sales.

Mettler-Toledo also boasts as obtaining the largest service and sales team among its competitors consisting of 9,000 in total. These sales and service staff assist customers directly in 40 countries.

Today Mettler-Toledo operates within three major product groups inc. value added services.

Laboratory Instruments

This group accounted for 56% of sales in 2024. Here, MT offers customers Lab balances, Pipettes, Analytical Instruments (Titrators, thermal analysers, PH meters) Lab software (LabX) , Automated chemistry solutions (Reactors) and Process analytics. All modern lab products are connected to LabX, MT’s software platform.

Industrial Instruments

Accounting for 39% of 2024 revenues. This group of products include, Industrial Weighing Instruments, Industrial Terminals, Transportation and Logistics (Automatic measurement and data capture solutions), Vehicle Scales, Industrial Software and Product Inspection (X ray and metal detectors for packaging)

Retail Weighing Solutions

Their smallest product group, accounting for 5% of sales in 2024. Here, MT sells multiple weighing and food labelling solutions for handling fresh goods (such as meats, vegetables, fruits, or cheeses). They also offer software solutions, which can integrate counter, self-service, backroom, and checkout functions with the stores inventory management systems.

As can be seen, Mettler-Toledo has positioned itself at every stage in their customers workflow and hold leading industry positions in each. From R&D research, quality control, scale and production, filling, logistics and packaging.

2) Fundamentals

2a) Growth

Mettler-Toledo growth has been achieved organically and through small bolt on acquisitions. Over the past 10 years revenue growth has grown at a healthy 5.2%. As a mature business with acquisitions not exactly moving the needle in terms of revenues (Mainly bolt ons) a 5.2% CAGR shows pricing power above inflation. As growth increased disproportionately during the pandemic, I believe these last few years of stagnant growth gives us a more true growth figure and one that can be relied upon when modelling.

According to industry analysts the Laboratory Equipment Market is projected to hit $60 Billion in 2032 which results in a 7.7% CAGR. Major drivers of this market's growth are increased demand for advanced diagnostic equipment, increased R&D expenditure in the pharmaceutical and biotechnology industries, and the increasing trend of laboratory automation.

One aspect of MT’s growth that caught my eye is their profitability exceeding revenue growth. Operating income, NOPAT, and Net Income, whichever you prefer, have all outgrown sales. (Chart below) This proves and certifies the companies execution of their continuous improvement culture. One factor is due to their percentage of service and consumable sales / total revenues which continues to grow, are accretive to Mettler-Toledo’s profitability and the mix should continue to favour services in the future. During 2024 service sales accounted for 24% of sales, up from 20% in 2022.

2b) Profitability

“Our culture of innovation, collaboration, agility and continuous improvement makes a tremendous difference and is a key competitive differentiator.”

MT’s CEO at J.P Morgan’s healthcare conference.

Management emphasize their unique culture embedded withing Mettler-Toledo on measuring every aspect of its business and tries to get a little better every day. I’m always sceptical when I see these quotes as they seem to be the new catchphrase surrounding Wall St. However, MT demonstrates this by their unbelievable increased profitability over the past decade. Personally, I haven’t witnessed such consistent margin expansion. (Chart below)

One key factor that needs highlighting. Real value creation is made through organic revenue growth an ROIC exceeding the companies cost of capital and to an extent, increased profitability if the business is able to sustain it. Mettler-Toledo seems to be a well oiled machine, has predictable mid single digit revenue growth and also has another driver with their service and consumables revenues increasing as a % of revenues “24% in 2024”.

Personally, I believe, unless market share is taken through better competitors offering higher quality products that incentivise customers enough to move away from MT products that are of the highest quality, data rich and ingrained within their business and workflow then I cant see these margins eroding. This is the perfect example of a competitive advantage at work.

Return on Invested Capital is another good indicator of capital efficiency and profitability. Mettler-Toledo again boasts impressive ROIC numbers inc goodwill and intangibles around 45% and excluding Goodwill and intangibles 90% in 2024. The longevity of these returns again shows the strength in the brand as many competitors would look to take share and erode these returns. This hasn’t happened.

2c) Balance Sheet

Mettler-Toledo boasts an excellent balance sheet.

Working capital efficiency is up as its becoming less a % of revenues releasing tied up cash.

Long term debt stands at £1.88Bn with a low interest rate average of 3.8%.

Goodwill, a common line item on the balance sheet is relatively low for a company operating in their industry.

Free Cash flow covers debt in 2 years.

EBIT / Interest Expense = 15x proving the ease of servicing short term debt obligations.

Mettler’s capital structure and their ability to pay creditors in times of distress are made possible by their healthy cash flow and low reinvestment rates. There seems to be no red flags when looking into the balance sheet which looks healthy and conservatively levered.

3) Allocation of Capital

As with any research into a business its important to look into where the cash generated from operations eventually ends up. As owners of the business we need to assess whether the cash is being deployed sensibly and where it’s most likely to create future value. This also gives investors an idea of where the company is at in its life cycle.

High reinvestment rates could indicate

Capital heavy business model.

Young company investing to expand.

Mature companies with excellent opportunities for future growth.

Low reinvestment rates could indicate

Asset light business model.

Few investment opportunities attractive enough to deploy capital.

Near the end of lifecycle with the company having near zero growth opportunities and in turn, trying to generate as much cash still available to owners.

This brings me to Mettler-Toledo. Their reinvestment rates are low resulting in high cash flow to shareholders, although this at first glance seems like a win win, It would be a much better scenario if the investment rates where high when we take into account the high ROIC they generate, however this isn’t the case. After deducting depreciation (A good proxy for maintenance capex) and including acquisition costs, the total growth reinvestment rate for MT is around 12% of NOPAT. Now, due to the high ROIC inherent in the business, this makes me believe that there aren’t enough attractive investment opportunities out there, otherwise this rate would be much higher. The outcome results in the majority of cash being deployed to share buybacks with the occasional bolt-on acquisition which mainly focus on high growth areas such as life science and software.

Buy-backs are a tricky topic, especially to highly rated companies as buybacks look expensive which signals a destruction of shareholder capital. I’ve come to the acceptance that some businesses are stuck between a rock and a hard place, they generate excellent returns but there are few reinvestment opportunities out there to create even more value. This results in either hoarding cash which generates bond like returns, paying out dividends or repurchasing shares. Out of these I believe MT are choosing the right option in buying back shares as historically shares have returned a 13% CAGR over the past 10 years, far more than the other options available.

3) Management

As always, Its important to analyse the management team. Your capital is in their hands and they could easily erode it if their incentives are driven by short term decisions that could harm the business in the long term.

I like to look into

Previous allocation decisions

Past Performance

Incentives

Insider Ownership

Mettler-Toledo CEO Patrick Kaltenbach has been in the role since April 2021, so his tenure has just passed his 4th year. During this time, stock performance is negative (As of writing). I believe any CEO taking on a role during a peak in a secular bull market would struggle to outperform during these uncertain times. However, stock price aside. Lets look into the business performance, what really matters. One important factor I’d like to point out is the growth in revenues during covid along with interest rates increases and inflation post, the business is up against really difficult comps. Personally I believe this performance is excellent. Although growth has been rather moderate, profitability has improved. Net income and operating margin has increased 7.2% and 6.7% respectively through high inflationary and interest rate environments.

Executives long term incentives are rewarded through stock options and PSUs. “For those not familiar with company incentives, they are awards given to management based on long term performance targets which aligns management and shareholders alike”. In MT’s case these are vested over 5 and 3 year periods and the amount awarded is based on stock price appreciation or “TSR, Total shareholder returns” as MT don’t pay dividends. The thresholds are shown below and are compared to the companies in the S&P 500 Healthcare and Industrial Indexes.

Mettler-Toledo also has a policy that management must hold stock in the company with the CEO required to own $5.5 Million value of stock upon the 5th anniversary of his tenure. Currently he is in his fourth year and owns $18.9 Million worth of stock as of writing (17,200 shares x $1,103). Accounting for all executives and directors, they own 0.77% of all outstanding shares.

As mentioned above on the capital allocation decisions over the past decade, Mettler-Toledo has been short of options resulting in a high amount of cash being spent on share repurchases. I also mentioned that given the options available, they have chosen the right path as shares have returned a 13% CAGR to investors. On the topic of acquisitions, MT seem to target bolt-on deals that complement their existing products that they are then able to scale given MTs vast capabilities. When I analyse a companies acquisition past, a huge red flag are overpriced acquisitions resulting in high amounts of goodwill on the balance sheet. Very rarely do companies create value through large and overpriced acquisitions and looking into MT they seem to have a conservative goodwill balance which shows managements discipline at deploying capital only when good opportunities arise and cross their desired hurdle rates.

4) Valuation

In valuing Mettler-Toledo I’ve used a NOPAT discounted cash flow and an Exit multiple model. I use both and use a blended average price to determine the intrinsic value.

4a) NOPAT dcf.

Assumptions

Growth in NOPAT = Reinvestment rate * Operational ROIC

Reinvestment rate = Capex + Acquisitions - depreciation

Discount rate of 10% (Forecast and terminal period) also my minimal hurdle rate

Terminal growth of 3%

In this model I have an intrinsic value of $876 dollar per share for Mettler-Toledo stock with a 10% discount rate. Not far off my purchase price of $960 a few weeks ago when we consider the EPS numbers of $40 per share. One important point I would like to point out with DCF models is the lack of accounting for business quality. To count for quality, they say we must lower our discount rate due to the lowered risk inherent within the businesses cash flows. However, I like to set a hurdle rate of 10% minimum and I apply this to even the highest quality companies.

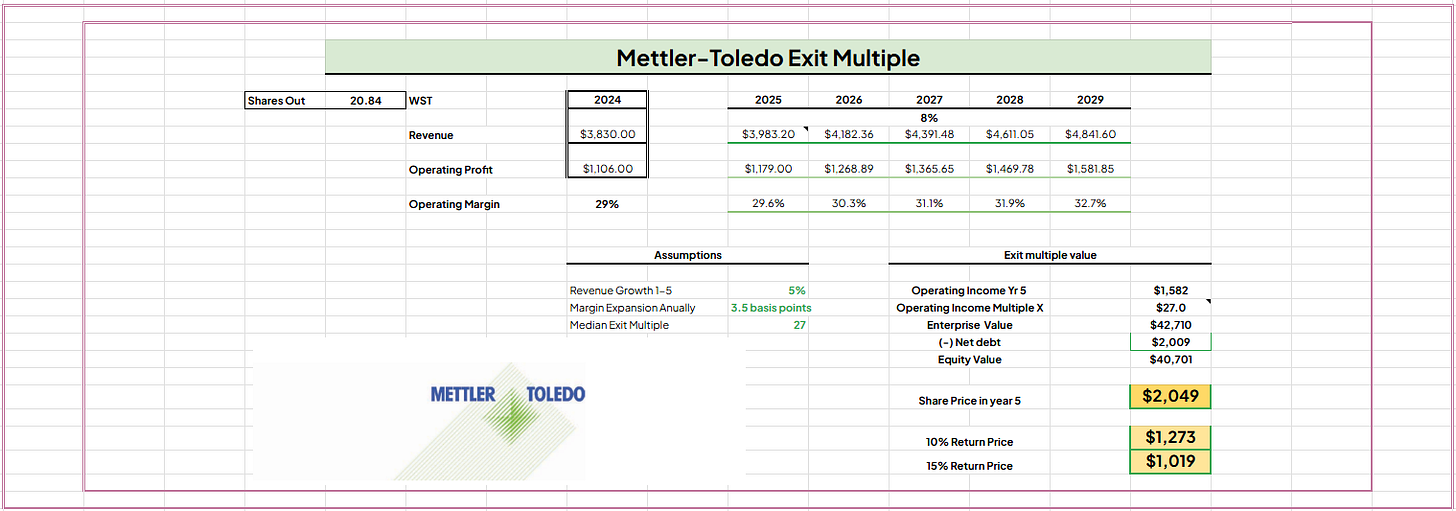

4b) Exit Multiple Model

Assumptions

Revenue growth 5%

Operating margin expansion

Shares outstanding of 18.84 million in the exit year. Results on a 2% buyback yield annually.

EBIT multiple 27x (MTD 0.00%↑ Median over the past 10 years.)

Discount rates of 10% and 15%

Here, we have a share price in year 5 of $2,049. I believe my assumptions are rather conservative considering historical standards. For a 15% return an investor would achieve this from a starting price of $1,019 and for a 10% return would be achieved at a starting price of $1,273.

Exit multiple models offer the investor an exit multiple of their choosing which takes into account the business quality and the respectable rating the market usually gives a business. Here a 27x EBIT multiple is high as a market whole but isn’t out of the ordinary for Mettler-Toledo.

Taking into account both valuation models my Intrinsic value for Mettler-Toledo is $1,074 using a 10% discount rate.

****** These are solely based on my assumptions and should not be used when making investment decisions.*******

5) Conclusion

Mettler-Toledo has never been “Cheap”. However, I believe the returns of late sub <$1000 for investors is favourable considering the quality of the business and consistency of cash flows.

Highlights

Vast global installed base.

Embedded software solutions that collect data and simplify workflow.

Regulatory barriers defer customers switching providers as they choose to partner with a trusted supplier that guarantees quality and reliability.

Products are a small initial cost for customers in their overall R&D budget resulting in Mettler-Toledo less at risk to economic downturns.

Consistent high ROIC, suggesting a large economic moat.

Culture of continuous improvement.

High margins.

Low reinvestment rate model.

Overall Mettler-Toledo is a fantastic business and one the market rates very highly. I class this as a low risk SWAN business and am willing to tighten my hurdle rate to gain exposure to what seems to be an excellent business with good management.

Thankyou for reading

DInvests

DRGInvests on X.

Disclaimer: I have a long position in Mettler-Toledo. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

Really enjoyed this analysis. MTD is a sneaky good (great) business. I’ve had my eye on it, but you’re right in saying it’s never really been cheap.