Today, Greggs displayed their trading update for the 20 weeks up to the 17th May 2025. The last five months have been hurtful for Greggs investors due to market sentiment surrounding the anticipated increases in operational costs and the tough consumer environment. However, results came in better than expected with the stock price up over 7% as of writing with what hopefully can be the start of an upward trend in the stock price to what I believe to be its fair value.

In this article I’ll briefly go over some highlights in the update and also an updated valuation to what I believe to be Greggs intrinsic value.

Operational Highlights (First 20 weeks of 2025)

Sales increased 7.6% to a total of £784 million pounds ✅

2.9% Like-for-like sales growth ✅

66 new stores opened. 46 stores closed. Resulting in new new openings of 20 new stores. Total stores in operation 2,638 ✅

Investments to increase supply chain capacity on track. Also in line with projected costs ✅

Management financial outlook for 2025 remains unchanged. Still expect a Like-for-like inflation increase of 6%.

Product Highlights

New products continue to perform well including their Pizza, Chicken Goujons, Wedges and also their Tik-Tok viral Mac and cheese option which satisfy a new evening customer cohort. Also over the ice drinks are now available in nearly 50% of stores (1300) ✅

Made to order, a new trail initiated last year which offers customers a new range of foods including Chicken burgers, Wraps and Fish finger sandwiches is now available in over 300 shops ✅

Introduced new healthy options such as Greek Yogurt and their Pesto and Mozzarella Pasta Salad ✅

A good start to 2025 for Greggs. Although no profitability metrics where displayed the results showed encouragement as Greggs still remains a great value retailer for on the go food options in this tough environment. Looking ahead, rising costs are still anticipated to continue to be a headwind to profitability with a lower expected growth rate anticipated. More details and to what extent on this will be available during their semi annual earnings report. Although I believe Greggs should be able to offset the majority with price increases.

In my opinion the Greggs investment case is still strong. A company with a leading market position domestically, a proven resilient business model due to their great value offering, still growing their store footprint 5% annually, owned supply chain, zero debt, produces excellent cash flow with an attractive dividend yield is enough for me to make it a top five position within my portfolio (Currently 8.1% allocation).

Valuation

Nopat DCF

*Assumptions within the model*

Next two years of high reinvestments result in free cash flow of $0 as all cash will be invested in their new stores and expanding their supply chain.

Growth driven by new stores of 5% annually + price increases

Discount rate of 10%

Terminal growth of 3%

No increase in ROIC.

With a 10% discount rate on future cash flows and based on my assumptions I have an Intrinsic Value for Greggs of £23.43 which is 7.3% below today price of £21.83.

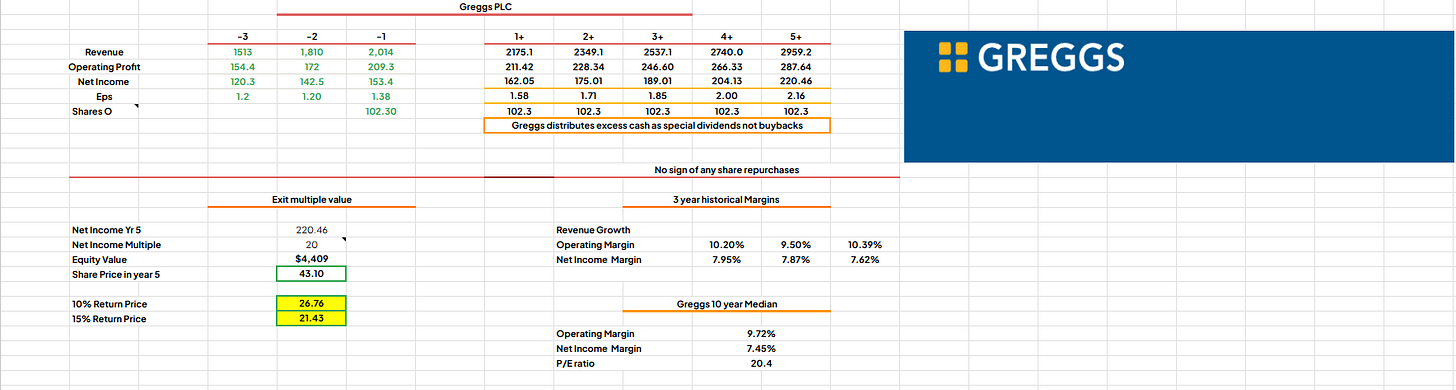

Exit Multiple Model

*Assumptions within the model*

Revenue growth 8%

Margins based on historical medians (Probably room here for expansion as their supply chain investments bear fruit)

Zero deduction in share count as Greggs distribute excess cash as special dividends.

Exit multiple of 20.4x

Discount rates of 10% & 15%

Based on the model. Greggs 10% & 15% discount rates results in an intrinsic value of £26.76 and £21.43 respectively.

Combining both models results in a weighted value of Greggs at a 10% discount rate of £25.09p. This equals a discount of 14.9% to its intrinsic value based on both models.

* These assumptions may not materialise*

As an investor who has continued to average down on my holding during extreme market weakness, I’m happy with these results.

Long Greggs

Thankyou for taking the time to read this short article

DInvests

DRGInvests on X.

If you enjoyed the article, for more updates and company write ups (Mainly business I own or businesses I’m interest) please subscribe.

Disclaimer: I have a long position in Greggs. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.