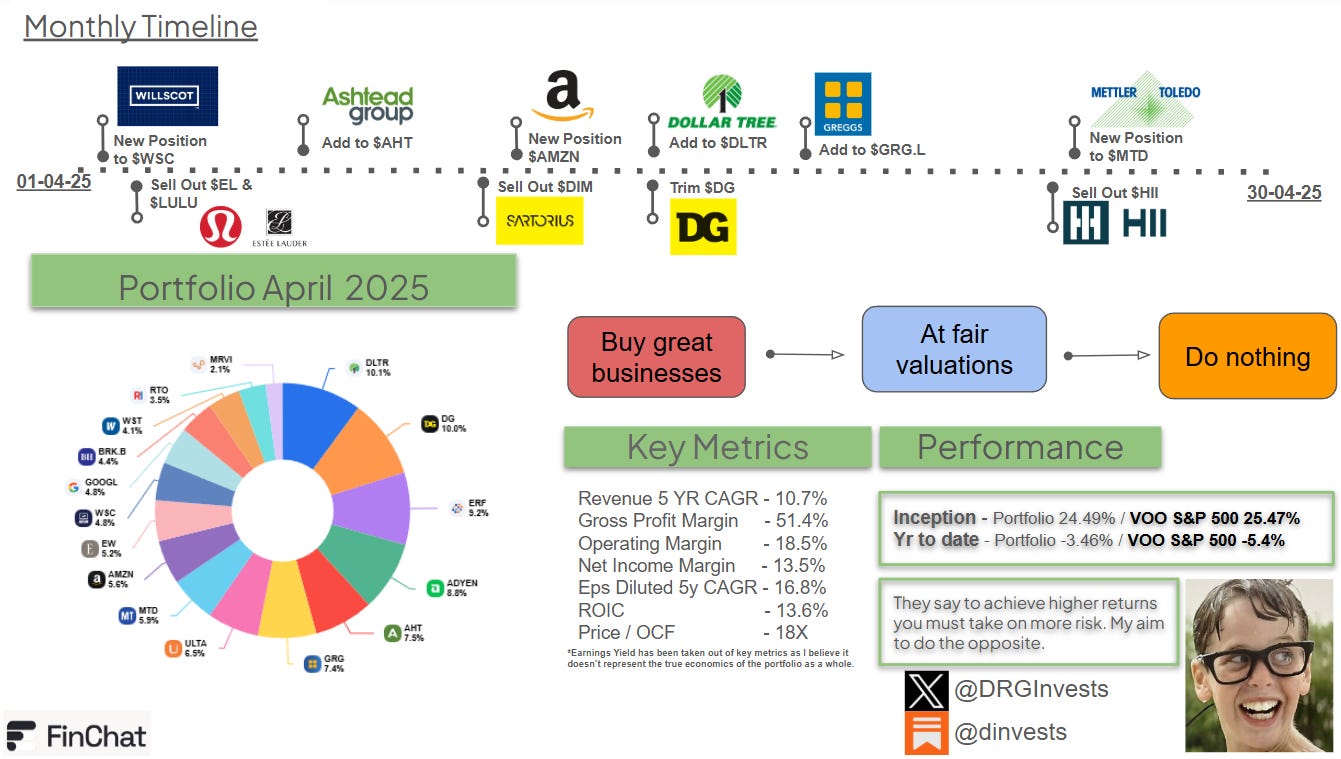

Hello everyone and welcome to this months portfolio update. April has been a roller-coaster with regard to the markets and its given investors some excellent buying opportunities to add quality companies for the long term.

As I mentioned in the chat section to my subscribers, April was a busy period with a lot of activity in the portfolio. I believe I added some fantastic businesses, cut out laggards and sold some short term plays for excellent gains. The “Do Nothing” part of my investment strategy is starting to become questionable. Jokes aside, when we look back at my updates, my core positions have remained intact with long holding periods.

Four positions were sold, three were added and I also added to existing positions I believe offer a better return potential. Overall, I believe the DInvests portfolio obtains higher quality, stronger economics, larger moats and more resilience than in the start of April.

Positions Sold

Estee Lauder ( Sold this position and realised my largest loss as an investor. My initial thesis was based on a turnaround with profitability getting back to normalised levels. However, this seemed to be a never ending battle with the turnaround taking longer than I was willing to wait. With China being a huge market for EL and the added risk of increased tariffs I believe it was time to accept defeat )

Huntington Ingalls ( After purchasing HII following their huge drop to the $160 range as I mentioned on my page, I sold out of the position for a 30% gain including dividends. Even though there are tailwinds in the coming years with AUKUS, it will take time to realise the full benefits. Ironically if I held on another week the gains would have been a lot better. Oh well )

Lululemon ( Sold and realised decent gains. Reason was to add into other existing positions I believed offered better return potential )

Sartorius Stedim ( Sold to purchase my Amazon position. DIM 0.00%↑ I believe to be an excellent company but a position in the portfolio needed to make way to obtain funds. Sartorius seemed the most expensive and offered the lowest return potential as the markets expectation is already high due to its high recurring revenues and its leading position in single use consumables within the bioprocessing workflow. A small gain was realised )

New Positions

Amazon (After a 28% drop in Amazon shares with valuation metrics reaching their lowest levels in over a decade I thought it was time to add this E-Commerce and Cloud behemoth into the portfolio. As an Amazon customer, I know first hand their commitments to offer value to their customers. Also, years of heavy investment has started to pay off with profitability starting to mount up. Will Amazon by a larger business in 10 years? I personally believe it can become the most valuable. The sky’s the limit and I’m extremely happy Amazon is in the portfolio for what I believe to be a very reasonable price )

Mettler-Toledo ( Mettler Toledo is my most recent buy. I managed to add at a forward EPS multiple of 22x or $960+ dollars. A decent price considering their leading positions in each of their markets. For those who aren’t familiar with the business they offer precision instruments and services for use in laboratory, industrial and food retailing. These instruments include balances, pipettes, Ph balances, titrators and automated lab equipment. Services include integrated software and calibration. MT has a strong continuous improvement culture and these are evident by the excellent improving economics over the past decade. )

Willscot Holdings ( Article on Willscot which was my deep dive in April can be accessed here.)

Holdings increased

Greggs PLC

Ashtead PLC

Dollar Tree ( As I mentioned and for those who follow me you’ll know I decided to implement a basket approach with Dollar General and Dollar Tree. In April, the market gave me the opportunity to adjust these holding favourably and are now equally weighted. Dollar General rose during the month due to their lower exposure on tariffs with the opposite for Dollar Tree. I took gains from my Dollar General position and reinvested these into Dollar Tree at depressed levels. Both holdings now account for 10% of my portfolio and after a long holding period are both showing unrealised profits )

Substack Activity

My Substack activity has been lower than usual this month but I managed to publish a deep dive on Willscot Holdings and an analysis on Pepsi Co with expectations of possible returns at todays depressed prices. Both can be accessed here.

Portfolio Performance

During April the DInvests portfolio was up 2.2%, driven by Eurofins, Dollar General and Dollar Tree. Ironically my top three positions. The market declined 0.81% during the period.

Performance since inception shows I’m still lagging my benchmark by 0.98%. Its getting closer. But, considering my businesses as one company, I believe future returns are in its favour over the Index at these current prices. Time will tell.

I hope you enjoyed this update.

If so don’t forget to subscribe.

Thank you

DInvests

DRGInvests on X.

Disclaimer: I have a beneficial long position in the shares mentioned in this article. My buys and sells aren’t recommendations. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

I believe Sartorius still offers good upside and I looked at mtd in the past but never found it cheap enough. It's a great business, but organic growth is not too high for it's valuation. I prefer other life sciences companies instead, but I won't role out that I'll buy it some day