February 2025 Portfolio Update

We are already in March !

I will start this update with an introduction. For those who are new to my Substack, let me introduce myself. I’m a self taught investor from Wales, UK, with a focus on strong / durable companies that I feel are undervalued by the market. I have a long term mindset but I am willing to trim and sell positions if I believe companies are highly overvalued or there are better opportunities elsewhere. Those who are familiar with my articles will realise I mainly post on positions I own, I like to be transparent with my subscribers and followers and I’ll continue to do so going forward.

Before I dive into my activity for the month, I’d like to remind you all that It’s the time of year Warren Buffett publishes his annual letter to Berkshire Shareholders. If you haven’t already, take the time to read it and if your feel inspired, head over to the archives and read them all, you will not regret it. The investment knowledge embedded in these letters are unmatched and better than any investment book.

February “Substack”

My Substack activity was consistent with prior months. I managed to publish three articles. Listed Below. I would highly recommend reading Huntington Ingalls and West Pharmaceuticals. Both new additions in the DInvests portfolio after significant price weakness after poor disappointing earnings reports and near term outlooks. Both businesses, I believe, have huge moats within their industries.

Huntington Ingalls : I’ve taken the opportunity to acquire shares in this large moat military shipbuilder.

West Pharmaceutical Services : The leader in mission critical injection components.

I also published my review on Estee Lauders earnings.

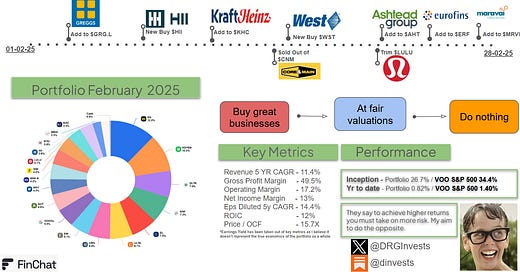

February “Portfolio”

A)Performance

February was a relatively poor month for the Portfolio and the index. Down 3.02% “Erasing January gains and some” and 1.29% respectively. The portfolio performance was driven by declines in Estee Lauder, Ulta Beauty, Google, Ashtead, Lululemon and Maravai Lifesciences.

Performance against my chosen benchmark is still lagging into 2025. FX exchange rates have also negatively contributed my returns. However, like Buffett once said

“Our investments are simply not aware that it takes 365 ¼ days for the earth to make it around the sun”.

Neither do mine. Although its good practice to record monthly and yearly returns I’m not phased by yearly underperformance.

I honestly believe certain large positions within my portfolio are highly undervalued, and will eventually reward the patient investor. How long that takes is unknown.

B)Buys and Additions

Two new positions where added in February. West Pharmaceuticals and Huntington Ingalls. I’ve written articles on both with links above. Both these businesses possess a few qualitative aspects I look for in a business.

High barriers to entry

Products are critical to customers

Possess pricing power.

I have to admit, the economics of Huntington Ingalls are far from great. They produce low margins and although demand is high “Over 50B in backlog” the time it takes to complete an overhaul project or build a ship “Many Years”, growth is slow but predictable. Not all quality businesses possess high margins and grow DD annually. At my buy price I believe I purchased a high quality business with a large moat that’s significantly undervalued. Remember, even the best businesses can be poor investments if purchased at the wrong price. Did you know there are other opportunities out there apart from the Mag 7? lol.

Additions to a few core positions where added, Eurofins, Ashtead and Greggs. Ashtead and Greggs both report earnings this week. These companies again showed some price weakness during the month which gave excellent opportunities to add to my already sizeable positions. Eurofins especially.

In last months monthly update I highlighted my admiration of Eurofins Scientific and their CEO Giles Martin. If this name is new to you please read up my article on the business.

Smaller positions, Kraft Heinz and my more speculative position in Maravai Lifesciences also got added.

C)Trims and Sells

Core and Main CNM 0.00%↑ was sold purely to fund my new West Pharmaceutical investment. I still believe CNM to be a high quality business but WST possesses better all round quality fundamentals. The switch was relatively easy to justify as CNM has low barriers to entry, their products are commoditized and the industry is cyclical being tied to the health of the economy. The qualities of these two are widely separated.

A small trim of Lulu was to fund higher conviction positions in Eurofins and Ashtead. Lululemon has been an excellent investment in the short period I’ve owned the company with an average price of $250 mark.

If you’ve reached the end of this article,

Thank you.

DInvests

Disclaimer: I have a beneficial long position in all shares discussed in this article. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice