AND THERE IT IS ……. Another Estee Lauder earnings report to ruin the day.

I wasn’t expecting much this quarter after the company withdrew their 2025 guidance and cut their dividend by nearly 50% in Q1. However, I was expecting to see some sort of positive commentary going forward, whether it be their recovery plan or sales channels, after all how long can this downturn last? This looks like another lost quarter for investors with halting progress once again. Lets dive into the results.

A) Financials

Net sales and organic sales decreased 6% y/y to $4Bn. This was due to the continued impacts from the overall challenging retail environments in Asia/Pacific and the Company’s Asia travel retail business.

Gross Margin, a particular highlight from the quarter came in at $3.04Bn with margin expansion of 310 basis points. This impressive increase in margins demonstrates pricing power and the progress obtained by their ongoing restructuring programme.

Operating Loss for the quarter was -$580 million. This was due to Goodwill and Impairment charges relating to their Too Faced and Tom Ford brands. Non-GAAP which takes into account non-cash charges came in at $462 million at an 11.5% margin. Both below (-20%) y/y comparisons. Margin contraction was due to increased investments in consumer-facing activities.

Net Earnings came in at a loss of -$590 resulting in -$1.64 EPS. Non-GAAP EPS was $0.62. Adjusted diluted net earnings per common share decreased to $0.62.

Net cash flows provided by operating activities over the last six months stands at $387 million, down from the prior year of $937. Capex stood at $273 million down from $527 million in 2023.

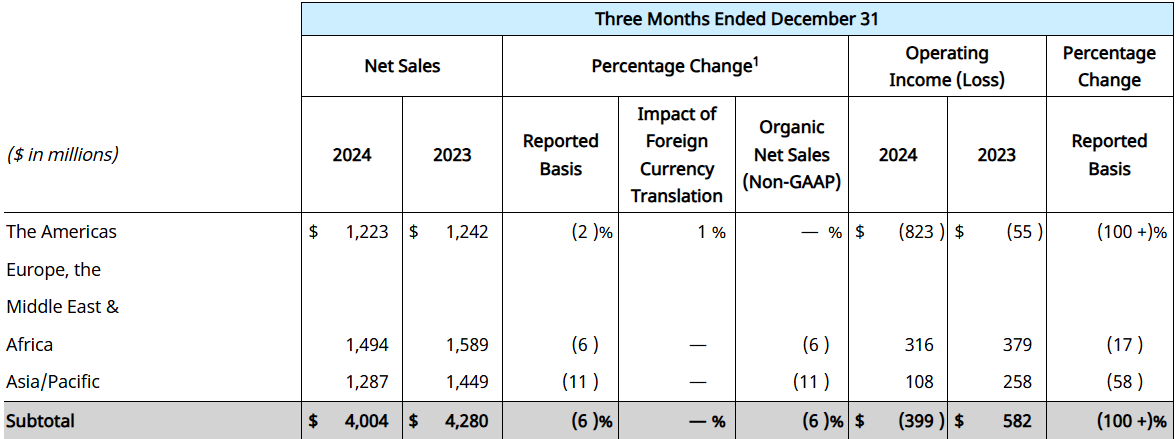

B) Sales by Geographic Region

The Americas

Net sales down 2% driven by the decline in North America, reflecting retail softness from some brands that led to lower replenishment orders, offset by the launch of several brands in Amazon’s U.S. Premium Beauty Store.

EMEA

Net sales declined 6% driven by a double-digit decline in the companies travel retail business.

Asia/Pacific

Net sales decreased 11%, driven by a challenging retail environment, including subdued consumer sentiment in mainland China, Korea and Hong Kong.

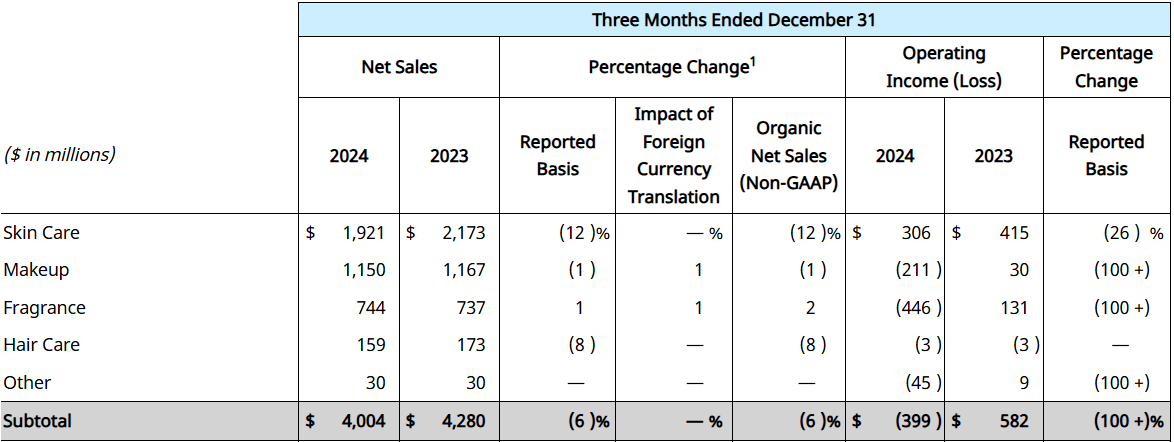

C) Sales by Category

Skin care sales declined 12% y/y to $1921m . If you are familiar with Estee Lauder you will know this category is by far their largest and most profitable. Shifts in sales mix with other categories determines Estee Lauders margins in any given quarter. This decline was mainly due to a challenging retail environments in Asia/Pacific and the Company’s Asia travel retail business. Operating income decreased 26% y/y to $306 million dollars.

Make up sales declined 1% y/y to $1150m . This was attributed from Tom Ford, Smashbox and M.A.C having declining sales and It goes without saying the decline was partly due to the challenges mentioned above. Clinique was a standout in the Q due to launches on the Amazon Premium Beauty Store. Operating income decreased to -$211 million dollars due to a $258 million of goodwill and other intangible asset impairments relating to TOM FORD and Too Faced.

Fragrance sales increased 2% to $744m, driven by Le Labo and its strong double-digit growth across each geographic region. Operating Income decreased, primarily due to the $549 million other intangible asset impairment relating to TOM FORD.

Hair Care sales decreased 8% to $159m, primarily by Aveda.

D) Beauty Reimagined and expanding their PRGP plan.

Beauty Reimagined tailored by Estee Lauders new executive team, Stéphane de La Faverie, President and Chief Executive Officer and Akhil Shrivastava, Executive Vice President and Chief Financial Officer.

This new initiative aims to Restore Sustainable Sales Growth and Achieve Stronger Profitability with an aim for double-digit operating income growth in the next few years. I know………………. we’ve seen it all before, a new management team steps in and wants to impress.

One thing that stood to me is the magnitude of this new strategy. 5,800 - 7,000 jobs are to be terminated, resulting in a leaner organisation, more accountability and to remove complexity.

Other highlights are their focus on faster time to market in high demand sub- categories and on trend innovation whilst investing more in consumer facing activities.

The expansion of the PRGP plan will result in additional charges between $1.2 and $1.6Bn, this is due to restructuring charges relating to the terminations mentioned above and also asset write downs. Management expects this to yield annual benefit savings between $0.8Bn and $1Bn which should restore operating margins and fund higher return investments.

CEO Stéphane de La Faverie

“Today, we are excited to launch Beauty Reimagined, a bold strategic vision to restore sustainable sales growth and achieve a solid double-digit adjusted operating margin over the next few years as we aim to become the best consumer-centric prestige beauty company,”

“While we recognize there is much work to do, we are confident that Beauty Reimagined is the way to realize our ambition. We are significantly transforming our operating model to be leaner, faster, and more agile, while taking decisive actions to expand consumer coverage, step-change innovation, and increase consumer-facing investments to better capture growth and drive profitability. Together with our talented employees, fundamental values, and incredible brands, Beauty Reimagined positions us to lead the prestige beauty industry once again.”

E) Outlook

Estee Lauders third quarter outlook, which again was disappointing, truly reflects IMO the uncertainty management have with regards to sales trends shifting in the positive direction.

Organic sales in the third quarter are expected to be challenged. Overall sales in the third quarter are expected to decline 8%-10% due to strong double-digit decline in the global travel retail business with adjusted EPS of $0.20 to $0.30. Again, one positive on the outlook is the expectation of continued gross margin expansion. Full year guidance was again scrapped due to the continued low visibility in the near term.

F) Conclusion

It goes without saying it was a very disappointing quarter from Estee Lauder. Personally, when I first purchased $EL I didn’t anticipate the recovery would take this long. This is yet again another wasted quarter for investors waiting for the companies fortunes to change. Investors have to either fold here or be patient and see if this new management teams operational strategies will bear fruit, we have to accept this will take time of course.

My original thesis isn’t broken and as a result I will not sell any shares. If margins manage to get back to prior levels, the returns from here should yield excellent results. Emphasis on the word “IF”. Gross margin improvement has proven they have brand pricing power. A focus on OPEX efficiency in the next couple of years leaning out the organisation and a strategic focus on consumer facing investments are key factors ahead I will be watching closely.

If we forecast sales no stay flat in the next few years (2027) with a LTM sales of 15.4BN and put on a 16% Ebit margin we end up with EBIT of $2.4Bn. Put Estee Lauders median pre covid EV/EBIT multiple of 22x results in a EV of $52.8Bn.

Using a capital structure of 77% equity and 23% debt which is their capital structure currently results in a market cap of $40.65Bn which is a 66% increase from the current MCap of 25Bn.

Obviously, this all depends on how the new management execute this turnaround and and bearing in mind these assumptions could not materialise at all. However, given Estee Lauders global scale and iconic brands I believe they have a favourable chance.

Thank you for reading.

DInvests

Disclaimer: I have a beneficial long position in Estee Lauder EL 0.00%↑ . I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.