Roper Technologies : The quality is undeniable, the question is "How much to pay?"

It's been added to the wish list.

Roper Technologies ROP 0.00%↑ , a business that came on my radar after reading “Lessons from the Titans” will suit most quality investors. This business fits all my criteria when looking to add quality into my portfolio. In this article we will look into its past, its evolution to being a low asset base, high margin business it is today and my valuation and expected returns going forward.

History Under Brian Jellison

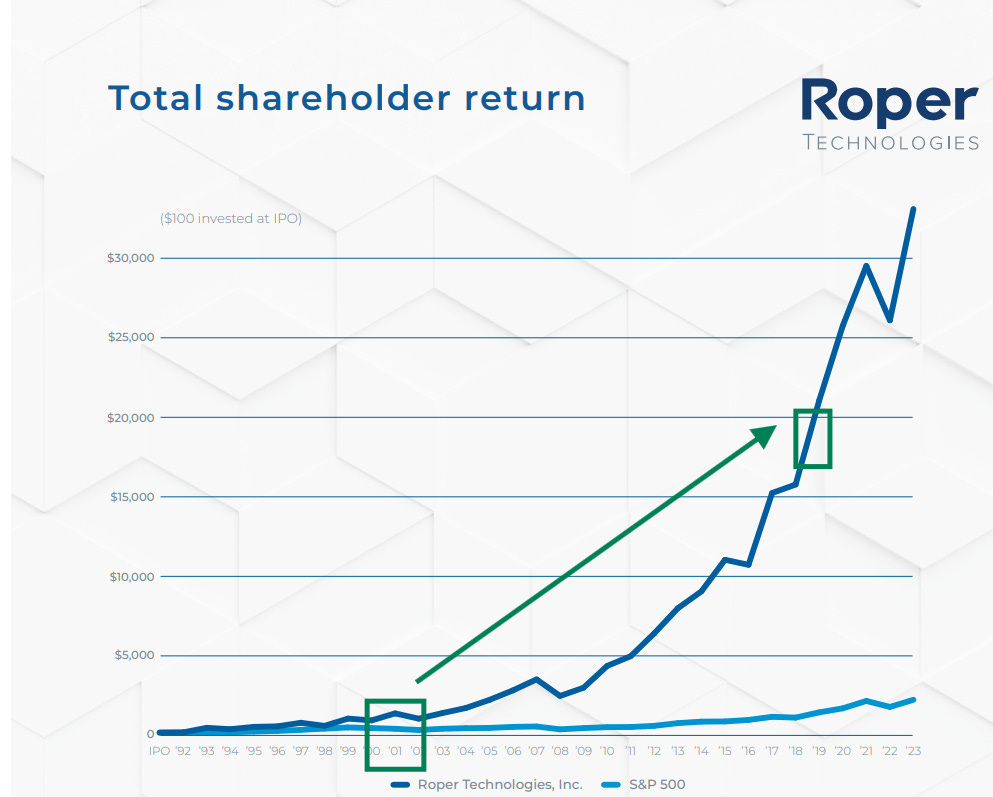

Ropers transformation began in 2001 when they hired CEO Brian Jellison. Before his appointment, Roper was a highly cyclical oil and gas supplier who designed and manufactured pumps and test equipment. Under Jellison’s tenure, between 2001 through to 2018, Roper acquired small niche businesses “mostly software within the last decade” that produced high margins with strong cash conversion that where inherently less cyclical than Ropers core business.

During this time Ropers stock price increased an impressive 1300%, the S&P returned just over 1/10th of this return during the same time frame. Jellison was the architect that created the Roper we know today, a high margin, asset light, low cyclical business with a decentralised operating structure.

Jellison, a former executive at General Electric and Ingersoll-Rand witnessed first hand the flaws in capital heavy industrial businesses. Although barriers to entry where high with this model, so where Capex requirements and working capital which tied up cash and limited cash flow.

Due to the high cyclicality inherent in Ropers core business, Jellison knew Roper needed a stronger foundation. Less cyclicality, high margins and excellent cash generators where high on his wish list. He realised that smaller, asset light businesses in niche industries produced higher margins and cash. The acquisition market for small niche companies was large, as bigger firms where more interested in larger flashy M&A deals. Most businesses Jellison wanted flew under the radar as their TAMs where considered too small or that their growth wasn’t attractive enough. After Introducing Kaizen events throughout the organisation, Roper was able to buy these “slow growers” achieving operational improvement and in turn creating higher profits and cash flows.

He had three requirements and wouldn’t pursue a deal if a business didn’t possess all three.

Low asset intensity

Good businesses in niche industries

Excellent management

I would have also assumed low cyclicality here and maybe it was a factor with the businesses he acquired?

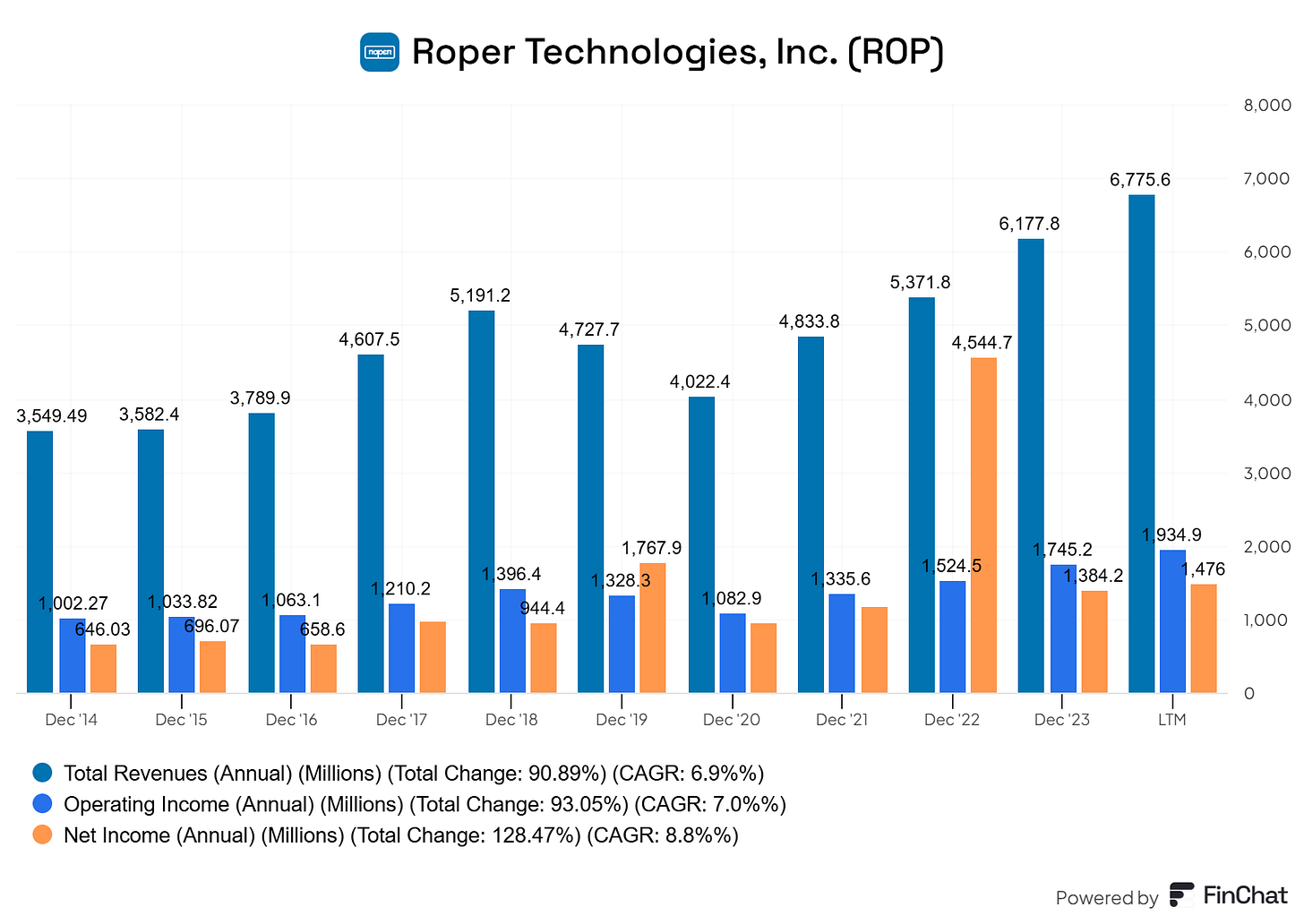

During his tenure Jellison managed to acquire 25 businesses, his first being “Neptune” in 2003 a water meter technology company and his last “PowerPlan” in 2018, a data management software business for asset intensive organizations. From sub - $600M in revenues in 2001, Roper managed to achieve $6775M in the LTM.

Brian Jellison retired on 22 August 2018 due to medical reasons and died shortly after in November 2018. His visionary legacy lives on within Roper to this day and was passed on to Neil Hunn who took over the CEO role. Neil Hunn who joined Roper in 2011 was trained under Jellison and was group vice president in its medical division.

Roper today.

A. The Business

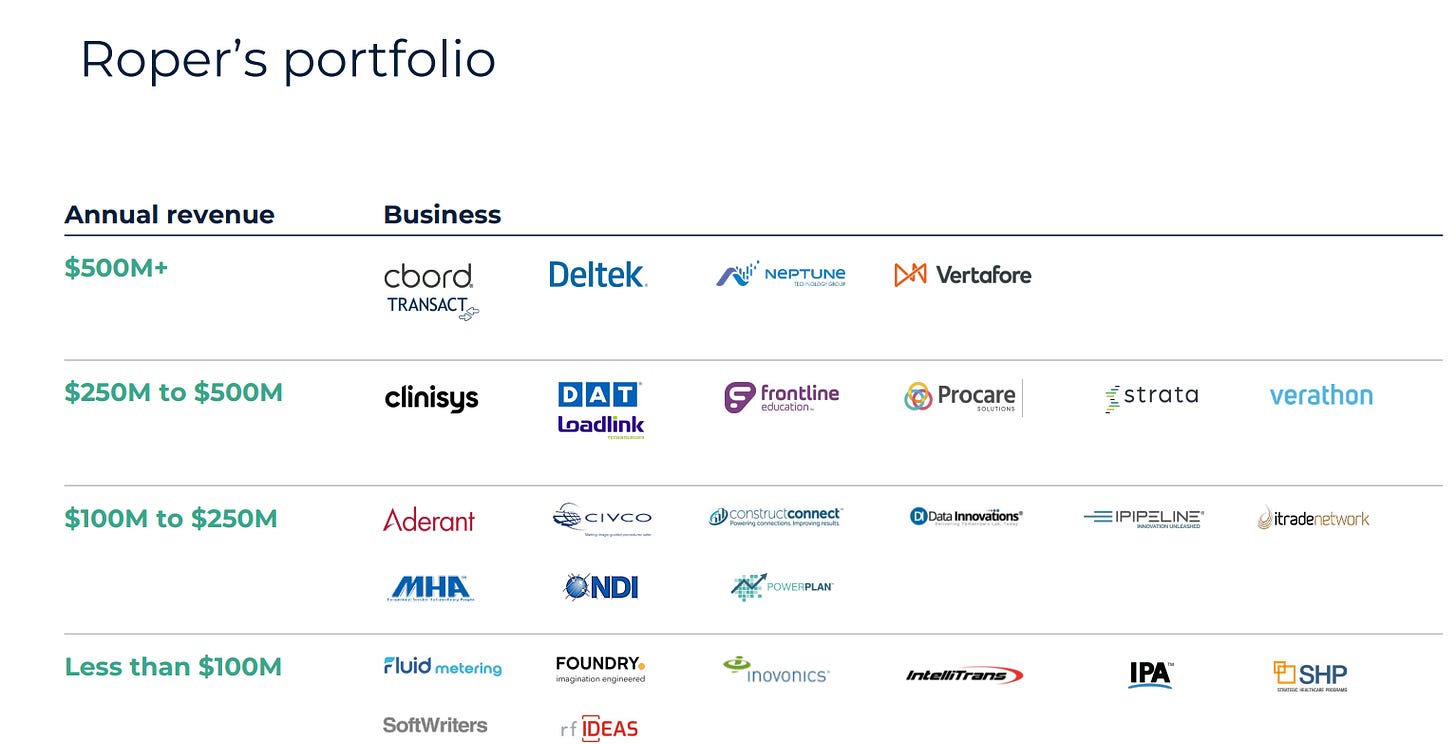

Today, Roper is still a diversified vertical software and products business serving multiple defensive industries such as Insurance, Food, Education, Construction, Laboratory, Finance and Transportation. Currently there are 28 businesses under the Roper umbrella and are all leaders in their industries. They have a decentralised structure with an owner-operator mentality for each individual business. Management have the autonomy to select the best strategy for their respective markets and their incentive structure is aimed to grow their businesses, not to achieve budget targets annually. This owner operator structure encourages management at the local levels to offer customers excellent service with a deep sense of intimacy which is shown by their high gross margins. Due to the closeness of their relationships with customers, feedback is constantly transferred to evolve and develop their services towards their customers needs.

Ropers Portfolio of businesses.

B. M&A strategy

Current CEO Neil Hunn (2020) on their M&A strategy

So the criteria for capital deployment really has not changed that much. It's always been rooted in finding businesses that have better cash returns than our existing. Over the arc of 20 years, that's gone from industrial products to medical products, then more software. The second criteria is always having a management team that is fundamentally focused on building the business versus transacting. And then finally, businesses that share the characteristics that all 45 of our businesses do, right, niche, leadership position, ability to invest in themselves to grow, high recurring revenues, high gross margins, et cetera. So those criteria have not changed at all and it won't change going forward.

This simple, disciplined and targeted M&A strategy has allowed Roper to achieve 70% of its revenues that are recurring and now gets more than half its EBITDA from software-related businesses. This highlights the excellent work they have managed to pull off over the years from being highly cyclical to highly predictable. The reason for the predictability is that most of the software they provide are mission-critical to their customers and are not considered discretionary expense but rather essential to their workflow. Due to Ropers low capital reinvestment needs, the majority of their cash flow “over 2B in free cash flow over the past twelve months” and after paying dividends, is free to allocate towards further value creating acquisitions. This flywheel has a long way to go. Their acquisition of TransCore (2004) “Their first entry into software SaaS” ignited their focus on asset light companies with high margins and cash flows.

However, don’t expect Roper to be pulling off any major deals in the future, that’s not their game. High growth businesses that are young in their business lifecycle and have high expectations are the ones Roper generally don’t gravitate towards. Businesses of this nature tend to invite competing bids by other businesses and therefore create demand resulting in lofty valuations which poses certain risks of overpaying and also impairment risks in future periods. Roper targets businesses with the financial characteristics I’ve mentioned above but focuses on small TAMs, the smaller the better. They want businesses that are number 1# or 2# in their industry and ones that have deep connections with their customers. There are two huge positives for this.

Disruptive competition risk is small (Who wants to enter a small TAM?).

Being 1# or 2# in their industry and being so close to what their customer needs, customer retention remains high.

This M&A strategy has proven highly successful and I believe they will stick to this disciplined approach for the foreseeable future.

C. Capital Efficiency

The measurement Roper uses to gauge its business performance is “CRI” Cash Return On Investment which is a proxy for ROIC. The reason for this is simple. Due to Roper acquiring asset light businesses, each deal will involve a large amount of goodwill, depressing ROIC, “a highly popular profitability metric used by quality investors”. The image below illustrates exactly that. Many great companies that regularly acquire have this flaw in their balance sheet and yet again keep producing high amounts of cash and create shareholder value. Danaher, ThermoFisher and TransDigm come to mind.

CRI is essentially return on tangible capital which is a better gauge for Ropers business model. This CRI metric has grown to above +500% in the trailing twelve months compared to sub 100% in 2001.

Neil Hunn on CRI,

It's been the core principle behind our capital deployment strategy. It's also been the core principle behind the way we compensate, reward and incent and train our operating teams in terms of improving this. Now it's both the earnings, so you're driving revenue, and margin structure on the numerator but you have to do it in a very thoughtful way as you're deploying assets in the pursuit of that growth on the denominator.”

In simple terms, Hunn is incentivising his business operators to grow revenues and margins which will grow earnings whilst also keeping assets low. This is essentially the perfect business model. Low reinvestment needs with predictable revenues, high margins and growing cash flows. This strategy has been proven effective and Roper will keep on applying this method indefinitely.

D. Growth

Ropers growth isn’t stellar. Far from it. They achieve in the ballpark mid single digit organic growth with the rest coming from acquisitions. Due to their leading positions within their industries we can assume the same going forward when taking into account the pricing power they obtain with their customers.

Forecasting additional future growth would be a guessing game with the amount of inorganic revenue they manage to obtain from future acquisitions. This acquisition market is large with many opportunities.

During Investor day 2023.

“So we often get asked this question, right? How can Roper continue to meet its growth objectives as you get bigger. And we need to deploy about $3,000,000,000 to $4,000,000,000 annually on average right now, maybe a little bit more as we grow. But I would just tell you that given the profile businesses we look to acquire, the universe of potential targets is really is quite massive.”

“We only closed 6 on 1200 targets, that's about 5 basis points. So we are definitely not running out of inventory in this very growing asset class that is private equity.”

With the available cash flow in the region of $2Bn and increasing annually going forward plus the availability of new debt, Roper is well equipped to capitalise in this market.

Operational efficiency is another factor to consider when forecasting future growth as Net income and FCF are clearly growing faster than revenues. I assume this as Roper is focusing on higher margin businesses to acquire with higher recurring revenues. During the past decade this has been the case.

E. Valuation

From personal experience I believe valuing quality businesses that are highly rated are better valued using a IRR model rather than a traditional DCF. The reason for this is due to DCFs treating all businesses equal. With IRR models we can assign a higher multiple to the business to reflect its superiority to other companies. However, I will add both below.

The DCF assumes

Revenue growth of 8% (5% or 6% organic - 2% or 3% inorganic)

Margins to increase 200bps after year 5.

Capex 1% of revenues

Terminal growth of 3%

Hurdle rate of 10%

Based on these assumptions we have a fair value for Roper of $346 which is 35% below yesterdays closing price of $533 indicating overvaluation. To get to fair value of $533 I would have to decrease my hurdle rate to 8%.

Before we get to the IRR model, I want to argue my case on why I’ve chosen a high exit multiple. Some critics might highlight this as being too optimistic, but would it be wise to go against historical data and put a 20-25x here? Personally I don’t believe so. In the image below, you will see Roper is highly rated and it’s been recognised by the market during recent years.

Here is my IRR model assumptions

Revenue growth 8%

Exit Net income margin 25%

P/E Exit multiple 35x

Discount rate 10%

Here, we have a share price in year 5 of $772. For a 10% return I would have to purchase Roper for $479 today, assuming all my assumptions are correct. Not too far off todays price. Personally I would like Roper to reach the $400-$450 region to give my model some flexibility of error. Will it reach my target price? Time will tell.

Conclusion

Roper is clearly one of a kind. The culture implemented by their former CEO Brian Jellison is now inherent within the business. His simple but effective M&A strategy of acquiring low asset base businesses in defensive niche industries is as relevant today as it was was when he took the role in 2001.

This article hasn’t gone into depth about the specific businesses under the Roper umbrella but rather to highlight the business quality and simple business model.

I wish I had a portfolio full of Ropers but unfortunately sometimes valuations become barriers, especially to a value focused investors like myself. I will pay up for quality, no doubt, but at times, some businesses are just too expensive for the hurdle rates I target. Roper unfortunately is within that bracket.

Its not all doom and gloom. Roper is now on my watchlist to capitalise on any future downturns. Once an acceptable price becomes available, this business will be getting added to the DInvests portfolio. Whenever I research a business like this it really does make me aware into how a business should really be operated and makes the majority of other businesses look mediocre. Maybe its worth paying up? From my value investor roots, I can’t get myself to press the buy button yet. I’m sure one day my time will come.

Thank you taking the time to read this newsletter.

I hope you enjoyed.

DInvests.

DRGInvests on X

Disclaimer: I have neither a long or short position in Roper Technologies. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

What makes the strategy work is Roper’s focus on established markets where competition is scarce and margins are high.

Roper now gets more than half its Ebitda from software-related businesses and it’s constantly buying more of them