Huntington Ingalls : I've Taken the opportunity to acquire shares in this large moat military shipbuilder.

When investors talk about companies in the aerospace and defense sector, we commonly see names such as Lockheed Martin, Northrop Grumman or Boeing.

Huntington Ingalls, a rather small and relatively less coveraged company in this sector is the largest U.S military seapower provider of leading surface vessels and submarines. HII is a military powerhouse with relatively zero competition (General dynamics Electric boat segment is the closest but both collaborate with certain projects) and long term tailwinds as the U.S, and other ally countries such as Australia continue to build out their naval fleet. Current backlog stands at $48.7 Billion (Dec 31 2024)

Their Mission

“To deliver the world’s most powerful ships and all-domain solutions in service of the nation, creating the advantage for our customers to protect peace and freedom around the world.”

HII 0.00%↑ has been on the DInvests watchlist for over 2 years and has only recently presented a generous entry point according to my models, which is why I’ve initiated a position after the most recent earnings report at $161. The reason HII made it into the portfolio was due to three variable drivers for future returns. These consist of EPS growth, margin expansion and multiple expansion which I believe are all currently depressed, whilst also collecting the highest dividend yield during the past decade at 3.35%.

1) The Business

Huntington Ingalls was once a subsidiary of Northrop Grumman. In 2011 it was spun off into the independent company it is today, the largest military ship builder in the United states. They design, build, repair, refuel and defuel nuclear vessels, amphibious ships, submarines and they also offer technical solutions. HII have three reportable segments 1) Newport News 2) Ingalls shipbuilding 3) Mission Technologies. I will cover each below.

1A) Newport News Segment

Newport News is Huntington’s largest segment contributing to around 50% of the companies revenues and profitability. Here, the company designs and builds nuclear vessels such as aircraft carriers and submarines (Collaborate with General Dynamics). Aircraft carriers can cost as much at 13Bn each and take years to build resulting in predictable visibility on future revenues.

This segment also offer services such as refuelling and complex overhaul (RCOH). Here HII 0.00%↑ refuels reactors, restores and modernise older fleet. A nuclear ship, like a US Navy aircraft carrier, typically undergoes a Refuelling and Complex Overhaul (RCOH) only once during its service life, which is usually around the mid-point of its 50-year lifespan, meaning it gets refuelled and significantly overhauled just one time throughout its operational career. As you can imagine, Huntington Ingalls has a monopoly here. The highly skilled workforce and complexity along with the high capital intensity required results in high barriers to entry and results in predictable after market revenues. Each RCOH takes nearly four years to complete.

This segments revenue is rather predictable with orders places years in advance, looking ahead this segment is projected to grow 4-5% annually.

1B) Ingalls Segment

Through their Ingalls segment, HII designs and constructs non-nuclear ships for the U.S. Navy and U.S. Coast Guard, including amphibious assault ships, expeditionary warfare ships and surface combatants (Flight III destroyers). HII are the sole provider of assault ships and one of two who build surface combatants for the U.S. Navy. Models include the Arleigh Burke-class Flight III destroyers and San Antonio-class.

1C) Mission Technologies

Mission Technologies was founded in 2016 and is Huntington Ingalls fastest growing segment which its poised to continue its growth outperformance over their shipbuilding segments into the foreseeable future.

Mission Technologies includes technical solutions in C5ISR (Command, Control, Computers, Communications. Cyber, Intelligence, Surveillance, Reconnaissance) mission systems, Cyber and electronic warfare, military training, fleet sustainment and unmanned systems. Leveraging big data and AI, these solutions are critical to mission preparation and decision making.

HII has been active in the M&A market to broaden the segments offerings with the most recent acquisition being Alion Science and Technology ($1.65Bn). Over the past 12 months this division earned 12 Billion in contract awards vesting over multiple years, up from around 6 Billion in 2023. Management believe the current revenue pipeline for this division is currently towards 75 Billion.

Revenues generated in 2024 reached $2.9Bn, an 8.8% increase over 2023. Smashing estimates of management guidance at the start of the year of $2.75Bn

Looking ahead, this segment is highly influential to Huntington Ingalls growth and a key factor into my decision to invest.

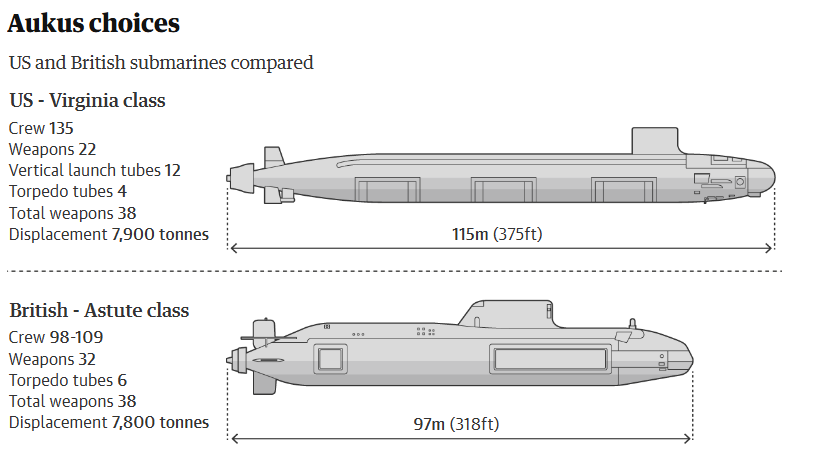

2) AUKAS

AUKAS is a partnership between Australia, United Kingdom and the United States which was formed on September 15th 2021. Its intended to promote a free and open Indo-Pacific that is secure and stable. This partnership is built around two pillars.

Pillar 1 focuses on Australia acquiring Nuclear Submarines (Six in total) and also rotational basing of US and UK nuclear-powered attack submarines in Australia.

Pillar 2 focuses on collaborative development of advanced capabilities in the following technological areas.

Undersea capabilities

Quantum Technologies

Artificial Intelligence and autonomy

Advanced Cyber capabilities

Electronic warfare

The program is forecast to cost Australia $268bn to $368bn between now and the mid 2050s with Huntington Ingalls being a kay beneficiary.

The Virginia class submarine is built by both Huntington Ingalls and General Dynamics Electric Boat division. In 2030’s the US plans to sell three Virginia class submarines to Australia and another two more if needed.

Investments have already been spent to boost shipyard capacity in anticipation for the increased demand, the most recent acquisition of W International, a South Carolina-based complex metal fabricator that specialises in the manufacture of shipbuilding structures, modules and assemblies.

CEO Chris Kastner

“It lets us efficiently add trained talent and state-of-the-art manufacturing capabilities to the urgent job of building ships, making it a unique opportunity to accelerate throughput at Newport News Shipbuilding in support of the Navy and AUKUS,”

3) Margin Expansion Opportunity

Irregular margins post 2020 are evident from the image below.

Prior to 2020 (COVID) HII was producing margins in the low double-digits to high singles. This was a time when inflation was tamed and 10 year treasury bills where between 2-3%.

The problem HII faces today, are the contracts negotiated pre-covid that where not estimated correctly when taking into account the high inflation rates that materialised. These contracts have weighed down HII margins to a decade low of 5.8% in 2024.

During the earnings call in the most recent quarter, management stated these contracts are reaching key milestones and will be replaced by new contracts that are inflation projected in their estimates and are in line with current market conditions. This isn’t going to materialise overnight, in 2025, 70% of shipbuilding revenues will be derived from pre-covid contracts, 60% in 2026 and in 2027, the majority of revenues will be obtained from contracts that reflect todays market conditions.

With efficiency being a key focus in the years ahead, plus the ending of pre-covid contracts tapering down through to 2027, management believe operating margins can get back to historical norms. Hypothetically, taking 2024 revenues and adjusting the operating margin to 9% we achieve just over $1Bn operating income.

CEO Chris Kastner

“Over the next 24 months, we expect to secure over $50 billion of contract awards. These contracts are being and will be negotiated with current performance and economic conditions in our estimates. They are expected to have a more balanced risk equation, be predictable in cost and schedules for our customers, and provide an opportunity to achieve margins more consistent with historical norms.”

4)Valuation

All of my models achieve the same conclusion, undervaluation. Obviously, these are all based on my assumptions that could not materialise.

A) Owners Earnings

Owners earnings is a valuation tool to hypothetically see what cash yield an owner can take out of the business after taking into account the reinvestment needed to keep its competitive position. An acceptable yield here is subjective. If the “Owner” is happy with the yield they could receive in the investment, then it can be considered undervalued for the risk taken.

Currently on depressed margins, HII are achieving an owners earnings yield of 7.2%. When taking into account the risk free rate, market premium and the factors discussed about potential margin expansion I believe this to be acceptable. For those who aren’t familiar with owners earnings here’s the formula.

Owner earnings = Reported earnings + Depreciation, amortization +/- Other non-cash charges – Average annual maintenance capex +/- Changes in working capital.

B) Exit Multiple IRR Model

Assumptions

4% Revenue Growth

Operating margins expanding from the current 5.8% to 9% in the exit year

Ebit exit multiple of 12.5X

Using managements confidence on improving margins to historical norms and revenue projections of 15Bn in by decades end, the model results in a share price for HII of $400 in the exit year.

For 15%+ annual returns “My preferred hurdle rate” I would have to purchase at or below $199. At my buy price of $161, this gives me the added margin of safety to compensate for any errors in the model.

5)Dividend

Huntington Ingalls distributes its excess cash to shareholders through share repurchases and a growing dividend. HII have grown their dividend in 11 consecutive years resulting in a current decade high starting dividend yield of 3.2%. The image below shows the discrepancy of past starting yields to today.

Going forward I’m expecting continued dividend growth as the pay-out ratio is well covered after reinvestments made into the business.

6)Conclusion

Huntington Ingalls isn’t every investors dream company as it has it’s flaws. These include slow revenue growth, tough labour environment and is relatively capital intensive. Shipyards are huge with large machinery that needs maintaining.

However, this business does offer predictable revenues, products that are in high demand, especially with their AUKUS partnership and high barriers to entry. This, with the added bonus of a 3.2% dividend yield and share buybacks, opportunity for margin expansion as pre covid contracts are set to finish and a re-rating from the market could easily outperform the the market in the future in my opinion.

What I have to accept is this isn’t going to change overnight. My hurdle rate is to double every 5 years which is equal to 15% IIR. IMO its definitely possible for HII to achieve these returns at current prices.

Thank you for reading

DInvests

DRGInvests on X

Disclaimer: I have a beneficial long position in Huntington Ingalls. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

Wow!

Very interesting. Why not 💭

Interesting article and company. Key for me is project execution risk - its quite high for large shipbuilding projects. Does the company have a history of cost over-runs, delayed deliveries etc. that could impact the valuation model?