Greggs stock price is still suffering after the most recent earnings update. I’m not complaining, in fact I’ve recently added more to my position making Greggs my number 1 position in the portfolio.

Whilst the majority of investors are chasing speculative names in semiconductors, , cyber security, data centre suppliers and AI, I’m more than happy to choose a boring bakery chain in the UK. If your from the UK you’ll know of the huge popularity which Greggs holds. They are a UK staple and known for their great food, cakes and coffees all the while offering these to customers at industry leading low prices.

The stock price after earnings reached £15.85p. Putting this into context the business totals a market cap of £1.6Bn give or take.

The Value Investor in me and the Greggs thesis.

Every time I analyse a stock my main focus is on the downside and in a really pessimistic scenario “bearing in mind a thesis isn’t broken” where could the stock price reach?

I treat every investment as an equity bond. As Buffett mentioned, unlike a traditional bond where the principal is paid at maturity and doesn’t grow above the agreed contract, an equity bond grows with the business. Here, Greggs offers a starting dividend yield of 4.4%, the business is still growing and if we use maintenance capex as a guide trades at around 8-10x FCF / 12.5%-10% yield. Not a bad starting point if you ask me.

Arguments and worries about Greggs reaching saturation is a concern. Current store count totals 2649. Greggs has ambitions to open “Well over 3000 stores” what this number means? I cant tell you? But if we use 3000 as a base then Greggs as another 15% of store growth left. They’ve also said they can reach 3,500 stores which equates to a ratio of 1:19,000 store/population. If this is a bull case then Greggs has over 30% growth left in store count. This excludes Like for like sales growth and price increases.

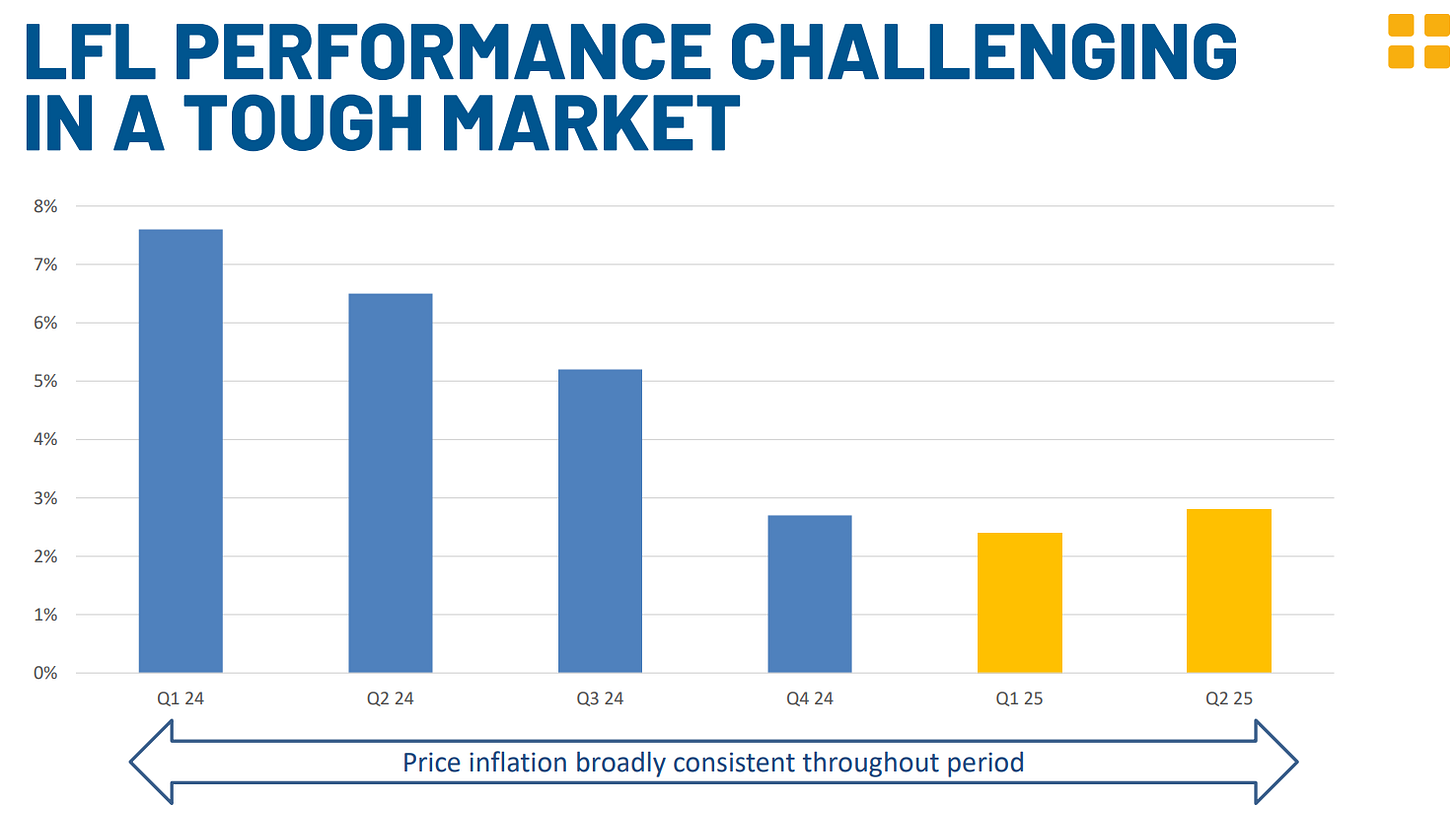

Store count aside, Greggs growth is still contributed by gains in market share. Life for like sales, a common measuring stick in retail is still positive. Although experiencing lower LFL and prior quarters, its more realistic. Excerpt from the most recent presentation

Debt kills. Looking into Greggs balance sheet they only have and only recently issued debt totalling £35 million and capital leases on their books. Deducting cash of £32.5 million net debt totals £2.5 million. Relatively debt free. Capital leases total £360 million and nothing out of the ordinary for a retail business model.

Greggs self funds its growth and doesn’t rely on outside capital. Greggs is a cash generating machine. In the LTM total cash from operations totalled £289 million. Management stated maintenance capex beyond their current capex cycle should represent 5% of revenues. As a proxy, if Greggs generates £2.1bn in revenues for 2025 then maintenance capex should be £105 million pounds. Deducting this from the most recent LTM CFO results in free cash flow of around £180 million. This results in a FCF yield 9-10x.

As an affordable food on the go retailer, this protects the business during economic downturns. Resilience during these times and the low risk to cash flows should command a more respectable multiple. Greggs, although not exactly fully protected here shouldn’t experience a severe downturn in revenues during bad times. This counter cyclical business model is another positive one needs to take into account.

So the thesis is simple.

A resilient food on the go retailer

Generating large amounts of cash

Zero debt (Close enough)

Self funded growth model

Attractive starting dividend yield of 4.4%

Still growing LFL sales and white space opportunity

After current capex cycle ends (2027) free cash flow should increase dramatically. This excess cash can be used to increase its dividend, distribute special dividends or start buying back shares.

As I mentioned above, you wont find articles on my Substack with crazy projections and speculative bets. I’m more than happy to pass buy investments I have no idea where they will end up in 10 years. Greggs fits with my investment principles. Fairly simple business model. Competent management. Generates large amounts of cash. Low debt. Occupies a leading position in the market it operates in. Creates value with high ROIC.

As my goal isn’t to lose capital but to preserve it and increase it modestly. I believe Greggs is an excellent business investment at these prices for those set objectives. Greggs will not 10x in 10 years. I know this. However, can its stock performance beat the index at these prices? I believe the risk/reward here is attractive to achieve more than satisfactory returns for the risks being taken.

The only adjustment I’ve made to my valuation model is the increase in ROIC after year two to 20% from 15%. I’ve done this due to the better performance of new stores and also the closure of underperforming high street stores. For those interested here it is…………………

As you can see I have an intrinsic value for Greggs of £20.95p or 32% discount to todays price.

Thank you for taking the time to read this article.

I hope you’ve enjoyed it.

DInvests

DRGInvests on X

Disclaimer: I have a beneficial long position in the shares of Greggs $GRG.L . I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

Always prudent to watch the downside of investments. Great job on this one, look forward to see their progress and your updates on it

Big time! I'm still wary of the recovery. If it talks about international expansion though I'm going to be mad I didn't.