Dollar General "Fundamentals Improving"

Dollar General has been a core position within the DInvests portfolio for quite some time. This wasn’t out of choice but rather due to the opportunity the market presented to me. The drop in share price during 2024 made Dollar General my largest position and eventually the addition of Dollar Tree made both companies over 20% of the overall portfolio. Struggling core customers, increased theft, larger debt loads, bloated inventories and fears of heightened competition taking market share brought the stock price down by over 70% likely driven by short term performance targets by institutional investors and fear among the retail community.

It’s been over 9 months since my last write up on Dollar General which at the time was still facing uncertainties and was overlooked by the market. They reported earnings on the 29th August 2025 which in my opinion where very solid results. Dollar General is displaying its cash generating power and the resilience of its business model. Core factors in my original thesis.

Earnings Update Aug 28th 2025

Financial Highlights Q2 2025

Net sales increased 5.1% to $10,727m ✅

Same Store Sales growth increased 2.8% ✅

Operating Profit increased 8.3% to $595.4m ✅

Net Income increased 10% to $441m ✅

Diluted Earnings Per share increased 9.4% to $1.86 ✅

$1.8Bn of cash generated by operations in the first 6 months ✅

Same Store Sales and EPS guidance increased for the full year ✅

Despite the negative movement in the share price on the day of the report, these results where excellent in my opinion. Its highly likely the market already had this priced in. Dollar General is up over 60% already in 2025.

Net sales increase was contributed by a 1.4% increase in traffic, 1.2% in transactions with the rest contributed from new store openings (A total net increase of 158 stores during the quarter) resulting in revenues of $10.7Bn.

Gross profit margin was a standout during the Q with an increase of 137 basis points. This was mainly contributed from lower theft (108 basis point contribution) and higher markups. Two tailwinds which where headwinds this time last year. As you can imagine, as a low margin business this 137 basis point increase contributes massively to the profitability of the company. Huge positives here.

SG&A as a % of sales increased to 25.8% from 24.6% in the same q in 2024. This is mainly due to higher incentive compensation and higher maintenance and repairs. A staggering $200 million of compensation is expected in 2025 which is a huge jump from the $58 million awarded in 2024. This is anticipated to be materially lower in 2026.

Operating profit increased 8.3% to $595m or a margin of 5.5%. Over time, new CFO Kelly Dilts expects operating margins to return to normalised levels.

“And then with all of the gross margin levers that we have in place, that's where we feel really good about getting to that 6% to 7% framework as we go over the mid to longer term.”

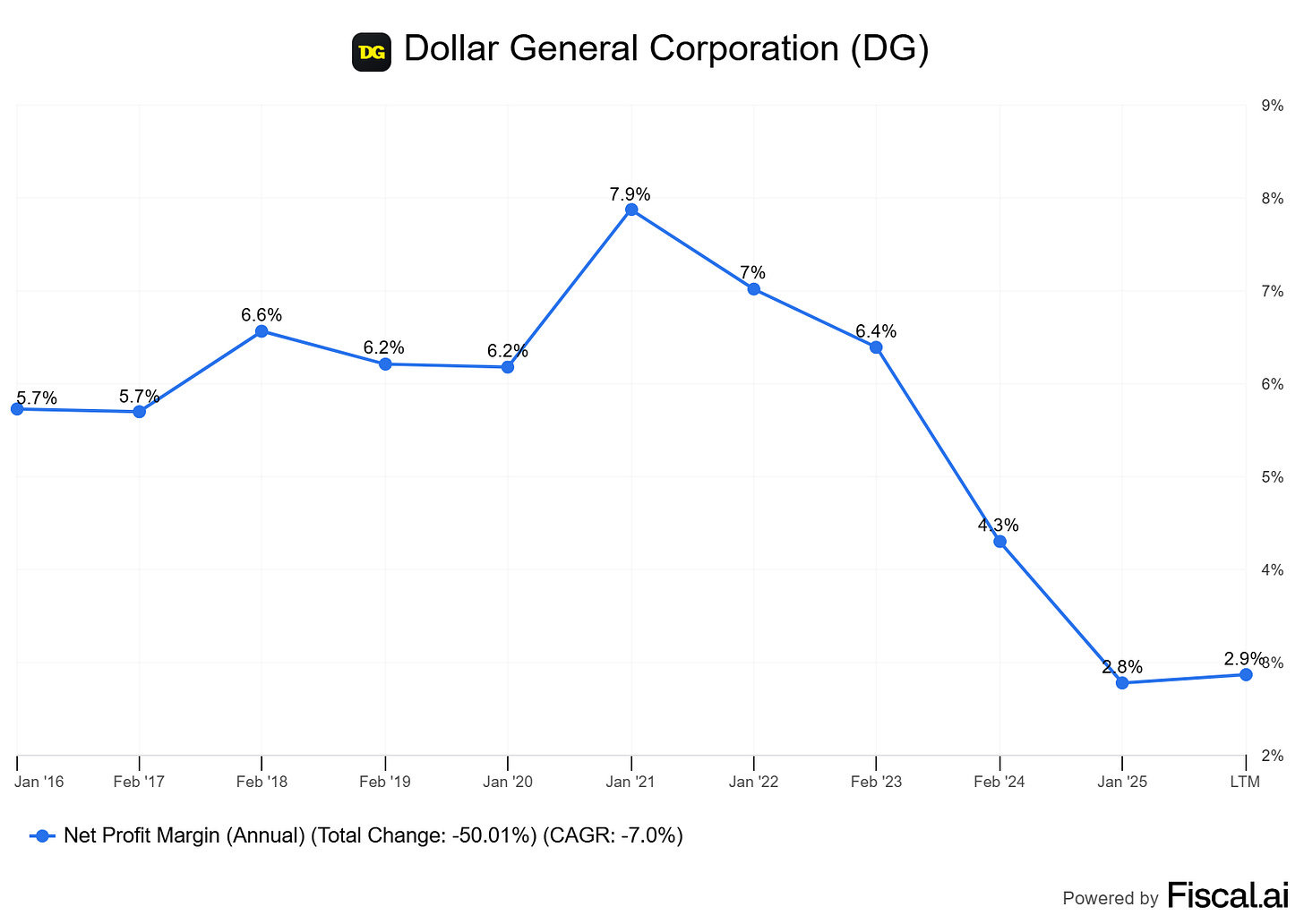

Net income increased 10% to $411m which resulted in EPS of $1.86. Although these results seem like a massive improvement on 2024 numbers they are still far off from the normalised margins of between 5% - 6% and DG still look like they might have a long way to go in their recovery.

Cash from operations for the first 6 months totalled $1.8Bn. With this cash Dollar General spent $693m on Capex, $259m on dividends and repaid $509m of debt. With this capex spend Dollar General added a net 204 new stores, remodelled 729 stores through project elevate and 592 stores through project renovate.

Overall a very positive first half for DG and its clearly rewarded shareholders this year with its impressive gain in share price. I suppose Buffett was correct, the market is a device for transferring money from the impatient to the patient. This seems fitting here.

Fundamentals

Looking at the fundamentals on the company shows massive improvement. During the crash in share price and before former CEO Todd Vasos retook the job, Dollar Generals fundamentals where deteriorating with slower sales growth, higher expenses, bloated inventories and higher debt levels.

Since Todd Vasos return, all metrics have improved massively by keeping things simple. His “Back to Basics” strategy is focused on improving operational efficiency and in-store experience. This resulted in removing self checkouts in the vast majority of stores aimed at reducing shrink, investing in more labour hours aimed at improving stores and customer experience, reducing the amount of SKU’s keeping on their best selling products and better inventory management.

As seen in the gross margin in the earnings above, shrink is being reduced showcasing the positive effect of removing self checkouts.

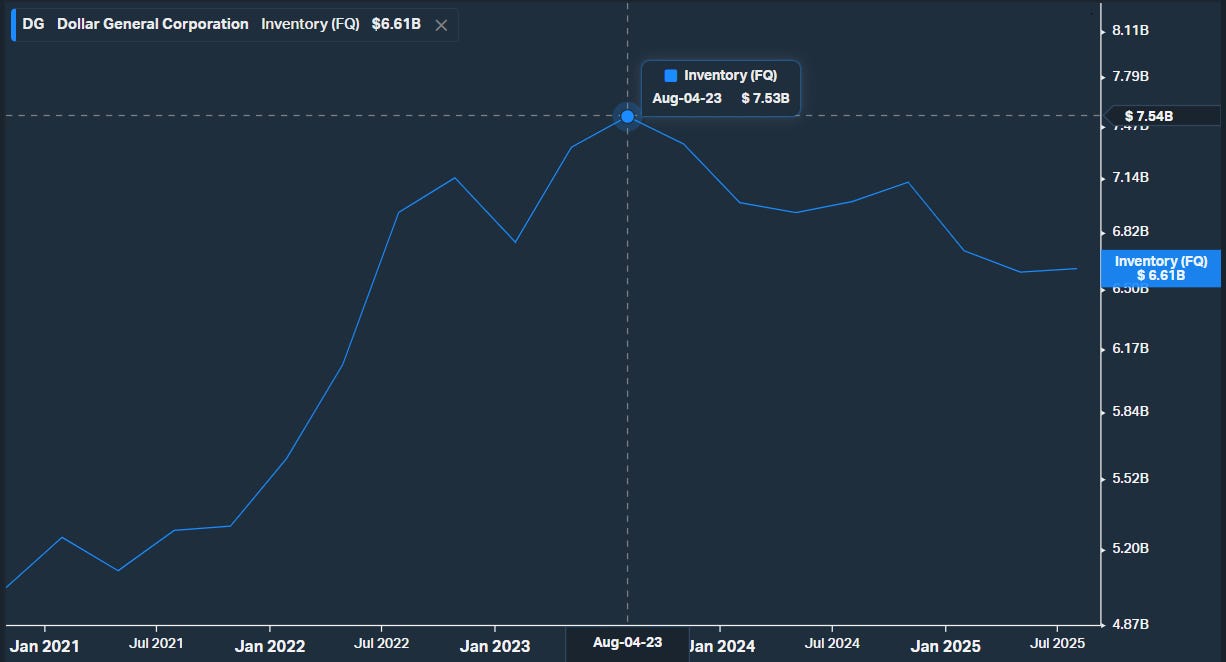

Looking at inventory we can see its improved massively. On a per store basis inventory has decreased by 7.4%. Each store has around $310 thousand dollars worth of inventory today compared to $350 thousand per store at their inventory peak. As you can imagine when having 20,000+ stores even the slightest of improvement moves the needle.

Why is inventory management so important? Firstly, excess inventory needs storing somewhere. Businesses will sometimes need to lease temporary storage facilities costing money. Second. Too much inventory can cause a company to offer their products at lower prices causing margins to decline. Third. Excess inventory is essentially cash tied up in working capital, reducing it releases cash and boosts cash flow. The best way to run a business that holds inventory is to have an optimal amount that avoids the problems mentioned above. The reason why Costco is so successful regarding their inventory is due to their fast inventory turnover driven by limited SKUs and customers buying high volumes of products at low prices, a flywheel that benefits the business and customer. Although its a different business model to Dollar General, inventories and the management of them still relate.

Inventory has been reduced by $900m despite having over 1,000 more stores.

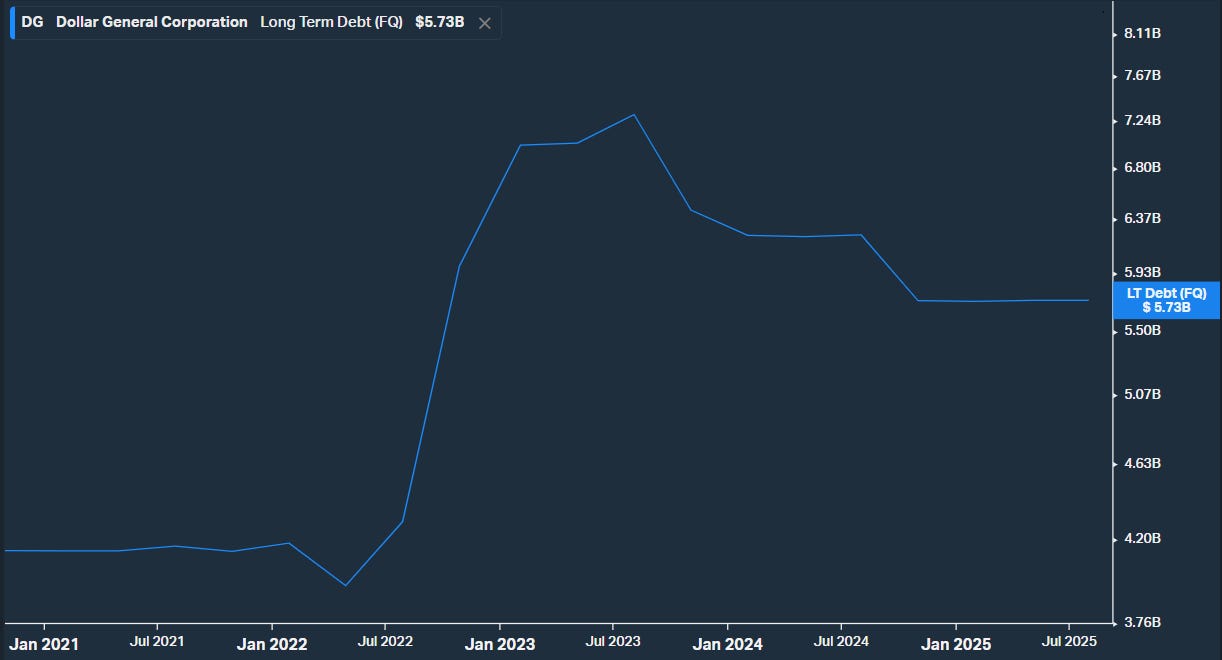

Another cause for concern was DGs increase in debt levels. Debt peaked in August 2023, around the same time their inventory peaked at $7.3bn, a huge increase in the $4bn they had at the same time in 2022. As you can see below, debt has been reducing with $1.6Bn repaid so far and they are also sitting on their largest cash pile since 2021 which stands at $1.2Bn.

Summary

Overall, despite recent share price movement after their most recent earnings I believe Dollar General is in an excellent position for the future, and for those who purchased during the lows are in an amazing position. Whilst recognising the cash generating power of these companies shareholders have managed to lock in a very attractive dividend yield and a share price gains. The company seems to have navigated through the headwinds thanks to the return of Todd Vasos and his back to basics strategy. The compensation awarded this year, although it seems high we cant argue management have done an excellent job. Dollar Stores are here to stay and will continue to serve their communities with their low prices and high convenience.

Long DG

Thanks for reading

DInvests

DRGInvests on X

Disclaimer: I have a beneficial long position in the shares of Dollar General and Dollar Tree. My buys and sells aren’t recommendations. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

Long DG!