Ashtead Group $AHT.L “Sunbelt Rentals” announced their full year results on 17 June 2025. Without any shocks in their release, it came in as expected.

Rental revenue in General Tools where relatively flat y/y due completions outpacing construction starts.

Speciality revenue continued its strong growth, impressive margins and ROIC.

Lower cash on disposals affected total revenues.

Lower reinvestment in rental fleet.

Free cash flow increased significantly.

Ramp up of buybacks with excess cash resulting in record cash being distributed to shareholders inc dividends.

Summary of the business

For those unfamiliar with the company, here’s a brief description of their business model. Ashtead Group, operating under the brand name Sunbelt rentals is the second largest rental equipment business in the United States behind United Rentals. Businesses in this industry typically have high capex costs as older fleet needs replacing and capital needs investing for rental asset growth. Another key mention is their countercyclical cash flows in times of economic downturns which has been evident in the most recent results and are also forecasted in 2026. In times of slow growth Ashtead can preserve cash flows by simply letting their rental assets age slightly and reinvest less in growth assets in turn boosting cash flows and returns to shareholders. The industry has many secular tailwinds such as industry consolidation, customers favouring to rent than to own, a growing rental market and pricing power.

Ashtead operates under three segments.

1.North America General Tools.

Here, Ashtead rents out a broad range of equipment to the non-residential construction end markets. Here Sunbelt offers Machinery including Dumpers, Diggers, Rollers, Traffic management, Lighting and Construction site surveillance equipment and any general tool used in construction such as drills, cutters, mixers, sprayers etc.

2.North America Specialty

Not tied to the construction markets. Usually a value added product after customers initially rent out general. Here Sunbelt offers Power & HVAC, Climate control, Scaffolding, Pump solutions, Industrial tool, TV and Film equipment, Temporary structures, Temporary walls and fencing among other products.

3.UK

Here, revenues are consolidated with general and specialty but sales within the United Kingdom. This is a much smaller portion of Ashtead’s overall business but still contributes over $200 million in EBITDA.

Ashtead has purposely been growing and investing a higher portion of cash into its speciality business. Over time its lowered the companies reliance on the overall construction market making it less cyclical. Currently, 50% is tied to construction and I believe this will continue to decrease as Specialty continues becoming a larger portion of Ashtead’s business.

The industry in which Ashtead operates in is highly fragmented as barriers are relatively low to enter the rental market resulting in many small players occupying their local markets. Here, along with United Rentals, the big players are able to consolidate the industry and grow inorganically through M&A. Bears argue both Ashtead and United rentals have zero moat, I tend to disagree as scale here is of upmost importance due to the optionality they offer customers making them a one stop shop especially on “Mega projects” where most peers are unable to meet demand levels, the bargaining power they have with equipment manufacturers and also the large cash flows which is essential during market downturns. The opportunity here is large with Ashtead having a target of 20% rental market share, nearly double its current share in the future.

2025 Performance

2025 Highlights ($m)

Rental Revenue - $9,980 (+4% y/y)

Total Revenue - $10,792 (-1% y/y)

North America General Tool - $6,397

North America Specialty - $3,487.4

UK - $907.3

Operating Profit - $2,557 (-4% y/y)

Earnings Per Share - $3.46 (-5% y/y)

Free Cash Flow - $1,790

42,000 new customers acquired.

Ashtead produced record rental revenues which increased 4% Y/Y to $9.98Bn. Although construction completions where outpacing construction starts, mega projects continued to be robust. Ashtead classifies Mega projects as those with revenues over $400million which include Data centres, Battery plants, Semiconductor factories and Electric vehicle manufacturers. These large projects are huge tailwinds for the largest players in the industry as most are unable to meet the equipment demand and expertise needed to support these customers needs, Ashtead and United Rental being key beneficiaries. A total of 42,000 new customers were acquired during the year which adds on to the 110,000 customers added during Sunbelt 3.0.

Brendan Horgan Ashtead CEO

“While completions continue to outpace starts in local non-residential construction, mega project activity continues to be robust, particularly in the data centre, semiconductor and LNG space, with the pipeline projected to grow from c. $840bn in the FY23 – FY25 timeframe, to more than $1.3 trillion in the FY26 – FY28 timeframe.”

Total revenues came in at $10,792 which was down Y/Y -1%. This slight decline was due to lower proceeds from used rental asset sales which totalled $467milion in 2025 compared to $858million in 2024, nearly $400million negative impact to total revenues. Rental revenues are what counts. EBITDA generated was just over $5 billion a 3% increase y/y with a margin of 46.5%.

North American general tool segment rental sales was $5,890million, up 1% y/y driven by rate increases and volume. EBITDA margin and Operating profit margin came in at 54.4% and 32.7% respectively.

North American specialty segment rental sales was $3,313 million, up 8% y/y, again driven by rate and volume. Ashteads cross selling ability is continuing to resonate with customers as over 50% of revenues come from customers initially renting general tools who are also renting over 3 lines of specialty. This is resulting in higher efficiencies throughout its North American segments. Ebitda and Operating profit margins came in at 47.9% and 32.5%.

The UK segment which doesn’t segregate rental assets and instead presents revenues as whole came in at $907.3 million in 2025. Rental revenues rose 5% Y/Y driven by rate and volumes. Ashteads focus is to improve efficiencies in this geography as the economic returns aren’t anywhere near as profitable as their US operations. EBITDA generated was $240 million at a 26.4% margin with operating profit of $69 million with a 7.6% margin.

Overall Ashtead produced $2.6 billion in operating profit and Net profit of $1.5 billion with EPS of $3.46 (which was down 5% y/y). This was mainly due to higher depreciation charges from a larger rental fleet, a positive on an EBITDA basis but a negative on a Profit basis.

Cash Flow hit a near record year in 2025 of $1.8 billion. This was expected as Ashteads plan to spend less on rental assets due to weakening demand. Growth expenditures where mainly used on their specialty segment as returns remain attractive. The flexibility shown here where Ashtead can preserve cash during times of weak demand and use the excess cash to return to shareholders or de leverage the balance sheet, two options they used during the year. This counter cyclical cash flow generation is a rare trait among companies. $670 million of debt was repaid and $886 million returned to shareholders through repurchases and dividends. The reason why I’m taking these counter cyclical cash flows as a positive is due to the resilience the business obtains through the business cycle. When demand is high they can invest in rental fleet obtaining their required hurdle return and during downturns they can repurchase shares at depressed prices whilst having a safe dividend and also the ability to acquire struggling competitors.

Return on Investment during 2025 as a group was 15%. By segment is listed below.

North America GT - 20% (2024 25%) Lower ROI due to lower utilisation on rental fleet.

North America Specialty - 30% (2024 27%)

UK - 7% (2024 7%)

Capital Allocation

Ashteads capital allocation framework is as follows.

Invest in organic fleet growth and Greenfields ✅

Bolt on acquisitions ✅

Dividends / Buybacks ✅

Ashteads capital allocation flexibility was showcased during 2025. As mentioned above, they are able to slow down capital spending on their growth assets during market downturns. After all, why spend when demand isn’t there?

During the year, lower utilisation in their general tool segment lowered capex massively with the same forecasted for 2026. Specialty continued to show signs of strength with the majority of capital allocated towards this growing segment. As mentioned earlier, 50% of customers initially renting general tool also rent three or more specialty products. Ashtead added 61 new greenfield locations during the year.

Acquisitions slowed during the year with only five bolt on deals completed for $137 million. The main reason being acquisitions where being priced too high. Ashtead remained disciplined in their acquisition guidelines and decided not to participate.

CEO Brendan Horgan

“I'll say this gently, only completing 5 acquisitions over the last fiscal year, we have been firmly holding to our valuation metrics, and it goes through the ordinary meat grinder in our business of both location, where it is, proximity to the rest, the specialty business line that it may bring, the culture of the business, the reputation of the business, but also the valuation, and we thought there was a bit of a disconnect there for a while. And none and I mean none of the businesses that we had interest in, have transacted. So there's a number of them out there that we have talked with and we have put our valuation on and they're choosing to contemplate, and we're choosing to wait.”

With a proposed final dividend of $0.72c making a total dividend for 2025 of $1.08c is an increase of 2.8%. If agreed, the payout ratio would equal 31% during the year and another year of dividend growth making it their 15th annual increase.

Ashtead announced in December 2024 of a new $1.5 Billion share buyback program of which $256 million was used in the Q4. The image below shows the large buybacks starting. In this forthcoming year, Ashtead plans to complete this new buyback program with $1.3Billion currently remaining. With todays market cap of $25.5Bn the buyback yield will equal 4.7%.

Another quote here from the CEO.

“Our current $1.5 billion buyback program which, as you know, was initiated just in December, we fully intend to complete the balance in the current year.

Guidance for 2026

Guidance was brief.

Rental revenue growth is projected to be between 0% - 4%.

Capex $1.8 - $2.2Bn

of which Rental Fleet $1.4 - $1.7Bn

Free Cash Flow $2.0 - $2.3Bn

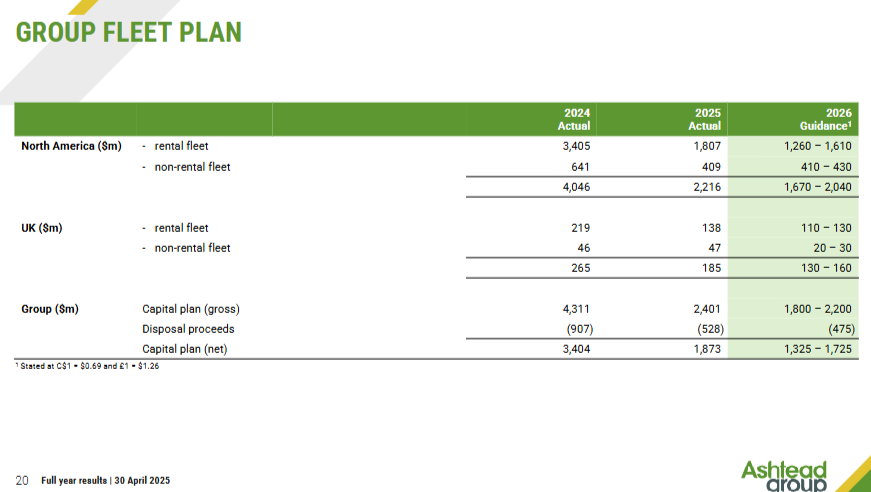

A breakdown in the image above. Of the Capex spent on rental assets, General tool is mainly replacement with some pockets of growth capex allocated to their specialty lines.

With this guidance I’m expecting Ashtead to mainly focus on efficiencies and generating as much cash as possible. Growth looks very minimal here but I believe the returns shareholders should achieve through dividends and buybacks is enticing enough to hold on to this behemoth rental for the growth and consolidation that’s evident in the future years.

Conclusion

2025 wasn’t a standout year of growth for Ashtead, this includes revenues and profitability on their income statements, however their added customers during the year (42,000) and their cash flows tell a different story. One huge lesson I’ve learned about the business this year is their optionality to slow capital spending during times of market slowdowns, which on a cash flow basis is great for the business. This confirms their resilience during economic downturns.

It shows the true potential of the cash generation available to shareholders on a maintenance capital spending basis.

They can de-leverage the balance sheet.

Stock buybacks at low valuations.

Plenty of cash to continue paying and increasing their dividend.

Also have the opportunity to acquire struggling businesses in the industry to consolidate it further.

While 2026 growth looks rather weak, 0-4% rental revenue growth Ashtead will continue its aggressive buybacks, acquire competitors and grow its specialty line. As a long term investor the slowdown in rental growth and the guidance for 2026 doesn’t bother me one bit. Its given me the opportunity to acquire shares at low valuations whilst achieving a nice shareholder yield while I wait. As the industry has low barriers to entry the market rates Ashtead rather low. I believe the market has got it all wrong with the competitive advantages inherent within Ashtead and their main competitor United rentals. Scale and breadth of offerings give the leaders in this industry a huge advantage and the future both businesses have looks promising as they keep growing customers and keep getting larger. The industry tailwinds (Onshoring, opt to rent rather than own, growth in the rental market and pricing power) remain strong and Ashtead will be a key beneficiary in the long term.

After approval from shareholders with support for of 96%. Ashteads listing from the LSE to the NYSE should complete in Q1 2026.

Long AHT 0.00%↑

Disclaimer: I have a long position in Ashtead. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.