Added Thermo Fisher Scientific

Share price weakness presents opportunity to acquire shares in this life science and pharma services giant.

Thermo Fisher (TMO) has been a nightmare for investors during 2025 with shares falling from $606 in late January to a recent low of $393, a 35% drawdown. Its among the worst performing stocks in the S&P 500 to year to date. The share price weakness is a result of extended pullback in overall global biopharmaceutical spending, lowered 2025 earnings guidance of 5% due to the near term impact of tariffs and also a reduction in academic and government funding by the trump administration. These are industry driven and not company specific.

Despite these near term headwinds, I believe Thermo Fisher is well positioned for the long term, driven by their scale, expertise, industry tailwinds and their high recurring revenues.

I’m not anchoring on their high price of $606 back in January but I do still believe this drawdown has been exaggerated, currently trading at a discount to what I believe to be its intrinsic value.

TMO is well positioned for the future driven by the many industry tailwinds and company specific competitive advantages which include;

Aging population.

An ever growing drug pipeline.

Demand for more advanced technologies with the advancement of more complex therapeutic modalities.

Higher mix of large molecule biologic research

Fragmented industry.

Thermo Fishers proven PPI business model.

Scale and optionality customers receive when partnering with Thermo Fisher.

The recent share price decline has presented the opportunity to acquire shares in TMO at what I believe to be at very reasonable prices for a high quality business. Lets dive in.

Thermo Fisher Scientific

ThermoFisher is an American life science and clinical research company. It’s a global supplier of analytical instruments, clinical development solutions, specialty diagnostics, laboratory, pharmaceutical and biotechnology services with leading positions in all their reporting segments.

“Our Mission is to enable our customers to make the world healthier, cleaner and safer.”

Their diversified products and services are the broadest in the industry. With Current revenues over $42 billion, 400 million customers, 2.5 million SKUs with 83% recurring sales from consumables and services and resilient end markets, Thermo Fisher is an attractive outfit. Image below details end markets, sales mix and geographic sales mix.

Thermo Fisher has four reportable segments

Life Science Solutions

Analytical Instruments

Speciality Diagnostics

Lab products and Biopharma services

1) Life Science Solutions

With revenues totalling $9.6 billion and an adj operating margin of 36% in 2024, TMO helps customers accelerate their life sciences research and bioproduction activities. Here, they offer best in class bioprocessing and research products such as single use bioreactors and consumables, reagents and research equipment under the brand names Invitrogen, Gibco, Applied Biosystems and Themo Scientific.

This segment is driven by scientific advancements and robust funding in the biopharma market. As drugs are getting more complex with a large shift from small molecule drugs to large molecule drugs, more advanced technologies are required and Thermo Fisher is a key beneficiary. The current large molecule drug pipeline is expected to grow at a 9% CAGR until 2030 plus the approvals through this timeline, locking in customers for the remainder of the products patent (If and when approved) confirm this is a very attractive market.

2) Analytical Instruments

This segment contributed $7.46Bn in revenues and operating margin of 26.2% during 2024. Thermo Fisher sells analytical instruments to research, production and analytical laboratories globally with leading positions in Spectrometry, Chromatography and Electron microscopy, also contributing to revenues are software and services. End markets include Pharma, Biopharma, Academic and Government, Semiconductors and battery manufacturers.

Tools here are expensive resulting in what Thermo describes as “High customer intimacy” as its in the best interests of customers to deliver feedback and work in unison to co-develop new innovative products, Thermo listens and delivers making it a win win for all.

Analytical instruments are used to identify;

Molecular and protein structures.

Determine the composition, concentration, and properties of substances.

Used to separate and identify different components.

Ensure quality control

In summary, analytical instruments are versatile tools that enable scientists to explore and understand the world at a molecular level and is crucial for drug discovery. This segment is driven by more strict regulations and more complex therapies being researched.

3) SPECIALTY DIAGNOSTICS

Their smallest segment out of the four with $4.5 Billion and adj operating margin of 26% in 2024 but their most lucrative along with their Lifescience segment regarding recurring revenues from single use consumables and services. End markets include healthcare, clinical, pharmaceutical, industrial, and food safety laboratories.

Here Thermo Fisher offers customers wide range of diagnostic test kits (Think blood tests, flu and virus tests, urine tests, substance tests and allergy tests), reagents, culture media along with the compatible instruments. These solutions help diagnose and and test many types of diseases and conditions (Leading positions in allergy, sepsis and multiple myeloma), food safety and also management and compatibility screens for patient transplants and solutions for post transplant monitoring.

4) LABORATORY PRODUCTS & BIOPHARMA SERVICES

By far their largest, Laboratory products & biopharma services accounted for 54% of 2024 sales with revenues surpassing $23 Billion with margins of 14%.

Up until 2021, this segment was 2nd in revenue behind Lifescience. The huge boost in revenues are contributed by two very large acquisitions for leading CDMO (Contract Development and Manufacturing Organization) and CRO (Contract Research Organization) companies Patheon and PPD (Pharmaceutical Product Development, Inc) in 2017 and 2021. These two leading clinical research and manufacturing businesses account to over 15B in revenues combined in 2024, this gives investors an idea of the scale of these two companies when we compare them to listed companies that offer the same services.

CDMO companies offer services, including drug development, manufacturing, and packaging (Fill and Finish), to pharmaceutical and biotech companies. Customers have realised the benefits of outsource drug development and production, saving time, money and resources.

CRO is slightly different. Here pharmaceutical and biotech companies outsource clinical trials to specialised companies such as PPD. Here the CRO will assist with various aspects of the drug development, from early-stage research to candidate monitoring and overseeing clinical trials, helping companies manage projects, data management, conduct studies, analyse data and ensure compliance with all protocols and regulations (A large hurdle for inexperienced start up Biotech’s). When sponsors decide who to partner with on their multi billion dollar research new drug candidate, I can assure you reputation and expertise play an important role in the final decision. CROs moats stems from their reputation and expertise as large companies in this space generally continue to gain share and dominate. PPD competitors include Medpace, IQVIA and ICON to name a few.

You’d like to believe Patheon and PPD should be able to offer great prices to their customers through their parent company Thermo Fisher, as consumables and equipment can be sourced at low prices, however, I’ve been unable to find commentary this topic.

Other revenue contributors for this segment are everyday laboratory products such as glassware, plasticware, pipettes, cold storage and incubators, chemicals and consumables to name a few.

As you can figure, Thermo Fisher has a wide range of equipment and services for the majority of laboratory needs making them a one stop shop for customers resulting in convenience, one invoice and one delivery.

5)Summary

Thermo Fisher is a global powerhouse driven by their extensive product offering and services they offer customers. As customers adopt Thermo Fishers instruments, consumables follow creating a flywheel which only grows with time as their installed base grows. The razor blade business model, which is a common trait company’s have exploited in this industry, protects and creates recurring revenues. These predictable revenue streams result in a market that highly rates companies such as Thermo, Danaher and Sartorius. And rightly so. This industry is highly fragmented with many scientific disciplines and applications which is another opportunity for growth through acquisitions, a key growth strategy for Thermo. More on this later.

Future revenue growth is driven by an ever growing drug pipeline, an aging population, higher R&D spending and more complex drug discovery resulting in more advanced technology.

2) Fundamentals

2a) Growth and profitability

Thermo Fishers revenues have grown at a healthy 10yr CAGR of 10.5%. This growth has come from industry tailwinds as discussed above and also inorganic growth through acquisition. The company believes they can achieve organic revenue growth of 7%-9% over the long term with Adj EPS targets in the mid-teens. As the industry is so fragmented with many companies operating in niche markets, Thermo Fisher is able to use its excess cash to acquire businesses that complement their current offerings or in new markets. TMO is not alone here with it being a common practice for many mature businesses so competition is fierce, however not many operate in the same way as Thermo Fisher and their competitor Danaher. When a company is acquired both companies use their respective business systems (In the case of TMO they call it PPI business system) to cut costs and operate at higher margins using their continuous improvement strategy and leveraging their scale and customer allegiance.

“PPI is at the core of Thermo Fisher’s culture, with a focus on continuous improvement that drives quality, productivity and customer allegiance and engages every colleague to find a better way, every day. PPI delivers competitive advantage, enables successful integration of acquisitions and drives differentiated financial performance.” CEO M Casper.

When a target company is targeted for acquisition, TMO assess what synergies can be gained when integration in complete. Each time an acquisition is announced to the public, management clearly state their financial goals for the acquired company which should be realised in time.

With profitability, both EBIT and EPS CAGR figures are greater than revenues which again showcases Thermo Fishers ability to effectively manage expenses through their PPI business system. Margins also tell the same story (Gross margin is lower due to a higher mix of revenues from their CDMO and CRO businesses)

As revenues and profitability where brought forward during the pandemic, I believe these growth rates are now much more realistic and back to normalised levels.

2b)Balance sheet

Balance Sheet Summary

Cash and Short term investments - $5.9 Bn ✅

Goodwill - $46.5 Bn 💭

Long Term Debt - $31.2 Bn ❌

Current Ratio - 1.8x ✅

Interest Coverage - 5.9x ✅

TMOs balance sheet is healthy. Current ratio of 1.8x (ability to pay off its short-term debts with its short-term assets) and their interest coverage is well covered.

Long term debt is on the high end, mainly from their recent acquisition of PPD for $17.4Bn in which they issued new debt to fund the purchase, however, TMO can handle such debt loads with the large amount of cash flow they produce. In fact, after paying dividends and reinvestment the company has over $5Bn of discretionary cash flow to do as they please. Debt is not a concern here IMO.

Goodwill and Acquired Intangibles amount to over $60Bn. Again, not uncommon for a serial acquirer such as Thermo. No impairments have occurred. Obviously there is heightened risk of impairments due to high amounts of Goodwill which affects GAAP earnings. Something to consider.

3) Capital Allocation

With any research into a business its important to look into where the cash generated from operations eventually ends up. As owners of the business we need to assess whether the cash is being deployed sensibly and where it’s most likely to create future value. This also gives investors an idea of where the company is at in its life cycle.

High reinvestment rates could indicate

Capital heavy business model.

Young company investing to expand.

Mature companies with excellent opportunities for future growth.

Low reinvestment rates could indicate

Asset light business model.

Few investment opportunities attractive enough to deploy capital.

Near the end of lifecycle with the company having near zero growth opportunities and in turn, trying to generate as much cash still available to owners.

Thermo Fishers reinvestment rate is relatively low considering the cash that’s generated. Consistent with past years, their reinvestment rate is between 15-20% of NOPAT. As with many mature businesses, I’m assuming they reached a capacity to reinvest in high return investments organically or ones that pass the companies hurdle rates. This results in high amounts of discretionary cash to deploy into inorganic investments such as acquisitions and share buybacks. Currently, after reinvesting into the business and paying dividends (Approx. $2Bn) they are left with around $6Bn to do as they please.

With this excess cash, It’s mainly used to acquire businesses in niche markets, in high growth areas or ones that complement the company’s current offerings. Unless an acquisition is large, as was the case with PPD, Thermo are able to fund acquisitions through their excess cash. This has been the case over the past 10 years. In 2025, TMO have already agreed and are in the process to acquire Solventum’s Purification and Filtration Business which is highly complementary to Thermo Fisher’s bioproduction business for $4.1Bn in cash which will add $1Bn in annual revenues to the company in 2026.

Looking ahead, I see the acquisition route being similar to the past. With such a fragmented industry offering a broad range of differentiated solutions, Thermo Fisher will have a broad pipeline to add to their existing businesses.

4)Management

As always, Its important to analyse the management team. Your capital is in their hands and they could easily erode it if their incentives are driven by short term decisions that could harm the business in the long term.

I like to look into

Past Performance

Incentives

Insider Ownership

Thermo Fisher CEO is Marc N. Casper who’s been in the role since 2009. He’s also the President and Chairman, again holding these positions since 2009 and 2020. His long tenure contributes to a deep and valuable understanding of Thermo Fisher’s history and day-to-day operations.

Over his tenure revenues have grown from $10Bn to $42Bn and Net Income $850M to $6.5Bn, a 4.2x and a 7.6x gain. Performance here is outstanding and all stakeholders have benefitted under Mr. Caspers reign. Hopefully more of the same in the future.

100% of the CEOs Compensation is performance based (50% RSU and 50% Stock Options). Basically, he will only receive value under these awards if the Company meets their key operational goals and the Company’s stock price appreciates. RSU’s are based on company performance of organic revenue growth, Adj earnings per share and total shareholder return when compared to a high performance peer group. In 2024, NEOs received 163% of their potential financial performance rewards of a possible 200%. This was adjusted downward to 157.5% when including TSR into the mix where TMO came out in the 14th percentile.

The company has stock ownership guidelines in place for Executives which are ( six times 6x base salary for the CEO, and three times 3x base salary for the other executives ) who have five years to build up to these positions which results in long-term ownership stakes in the Company. Additional guidelines are set for the CEO, who after receiving performance based RSUs must hold these shares for two years before any sales. These guidelines align their interests with that of shareholders.

Thermo Fisher also have time-based restricted stock units which incentivises long term retention of key personnel.

5) Valuation

Nopat DCF

Assumptions

Growth in NOPAT = Reinvestment rate * Operational ROIC (Ex Goodwill and acquired intangibles)

Reinvestment rate = Capex/NOPAT

WACC of 7.6% (Forecast and terminal period)

Terminal growth of 3%

On the assumptions above, I have an Intrinsic Value for TMO 0.00%↑ of $378. Based on their re investment rates and their operational ROIC, NOPAT grows at 8.4% and 10% in the 5 and 10 year forecast period. I’ve used their WACC of 7.6% (which stays the same throughout the model as TMO is a mature business, capital structure should remain around these levels) with a terminal growth rate of 3% into perpetuity.

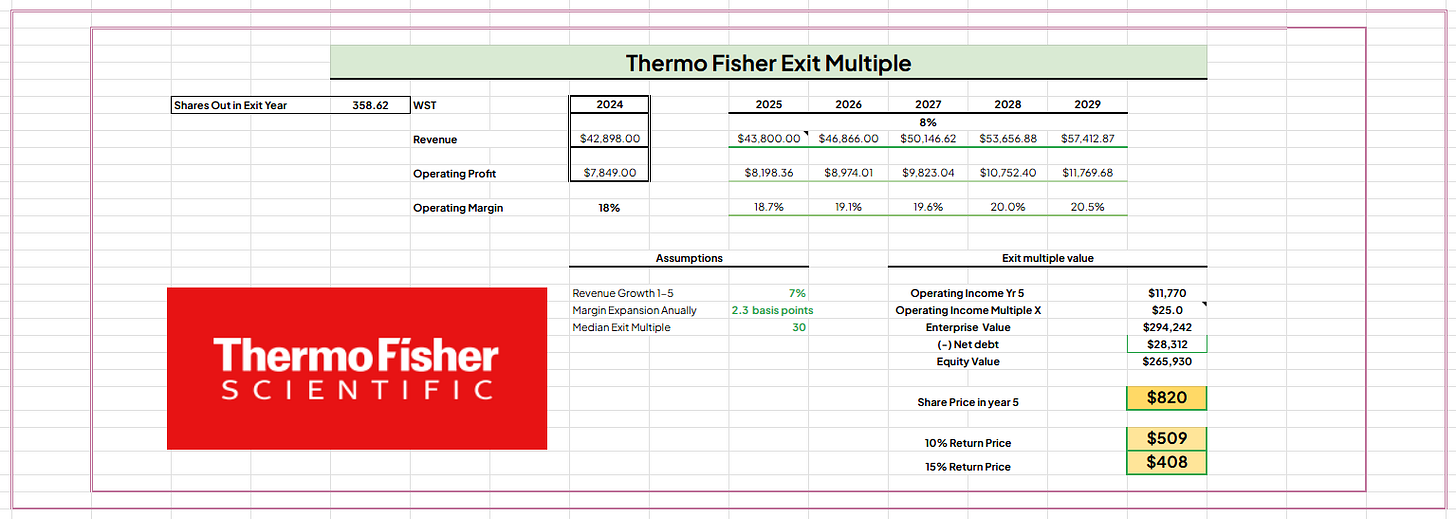

5b) Earnings multiple model

Assumptions

Revenue growth 7% (Low end of LT guidance)

Operating margin expansion of 2.3 basis points annually. (In line with past)

Shares outstanding of 358 million in the exit year. Results in 5% shares repurchased in next 5 years.

EBIT multiple 25x. Below TMOs median over the last 10 years of 30x. Discount rates of 10% and 15%

Here, I have an Intrinsic Value of $509 with a discount rate of 10%. This results in a share price target of $820 in the exit year.

Exit multiple models are highly sensitive to the exit year multiple. Currently TMOs median exit EV/EBIT Multiple sits at 30x. Using a 25x I’ve implemented a cushion for any contraction.

Revenue growth is at the low end of TMOs long term guidance at 7% and operating margin will expand 2.3 basis points annually driven by TMOs PPI business system.

Blending both models results in an Intrinsic Value of $444 (10% below the share price as of writing of $401) Personally, I believe NOPAT DCFs are too conservative where at times its tough to truly appreciate business quality into the model, with exit multiples the investor can account for quality into the exit multiple.

⚠️🚨****** These valuations are solely based on my assumptions and should not be used when making investment decisions.*******🚨⚠️

6)Conclusion

Thermo Fisher is a global powerhouse in the Lifescience, Analytical, Diagnostic and Lab services protected by deep customer relationships and installed units. Currently down over 30% from its high sitting around the $400 range, I believe its highly likely investors will achieve a decent return going forward driven by the favourable long term industry trends.

Aging population.

Increased mix of biologic drug discovery.

High Recurring revenues.

Drug patents protect future revenues.

High regulatory barriers.

Organic revenue growth is projected to be between 7-9% in the long term with the addition to take advantage to consolidate the industry through optionality for future acquisitions which should deliver growth in the double digits. Thermo Fishers PPI business system should continue to yield better economic results resulting and higher margins. The management team in place also reassures investors the business is in capable hands with long tenures throughout the executive team who have a proven track record of operational success and shareholder value.

Notable risks include the large debt on the balance sheet, although easily manageable through the cash generated by the business it would be bullish to see the company de-leverage slightly. Also, again on the balance sheet its worth highlighting the large amount of goodwill sitting at $46 billion which could trigger impairments in future years if acquisitions are underperforming, although a non cash expense it will still hurt the stock price in the short term if any occur.

Thermo Fisher is a great business with excellent management, in a very attractive industry achieving high operational ROIC with many options to reinvest future cash flows into high return investments, currently trading at a very reasonable valuation in my opinion.

I started accumulating shares in May and have continued adding in June.

Thankyou for reading

DInvests

DRGInvests on X

If you’ve enjoyed this article be sure to read my other articles.

Disclaimer: I have a long position in Thermo Fisher. I can’t guarantee the accuracy of the information provided in the newsletter. All statements express personal opinions and information gathered online. Any estimates, forward looking statements and assumptions made in this newsletter are unreliable. Do your own research. Any information in this newsletter is for educational and entertainment use only and should not be taken as investment advice.

Definitely an opportunity at current levels. The CEO will continue to deliver

Why do you think the market is mispricing this at 15% forward returns?